Keeping with my new tradition, I’m here with a quick-hitting recap of Nintendo’s latest annual results.

I’ll then look ahead to its current fiscal year, the 12 months ending March 2025, during which the company will officially reveal its next hardware.

Don’t worry. I’ll have my usual charts and reactions, just in an easier format!

Here’s the highlights for Nintendo’s 2024 financial report:

- Both revenue and profit bounced back to growth in the single digits.

- Annual Switch shipments were 15.7M, above its latest guidance.

- During the latest quarter, Switch passed 140M sold lifetime.

- Over half of software sales were digital for the first time ever.

While unit sales for consoles and software declined last year, Nintendo saw financial growth due to a depreciating yen, a shift to the premium Switch OLED model, shifting spending towards digital content and a sizeable impact from April’s The Super Mario Bros. Movie.

“For hardware, by continuing to convey the appeal of Nintendo Switch, we try to not only put one system in every home, but several in every home, or even one for every person,” management wrote. “Another objective is to continually release new offerings so more consumers keep playing Nintendo Switch even longer and we can maximize hardware sales.”

Scroll ahead for the full rundown and predictions for an exciting, and crucial, time in the company’s history.

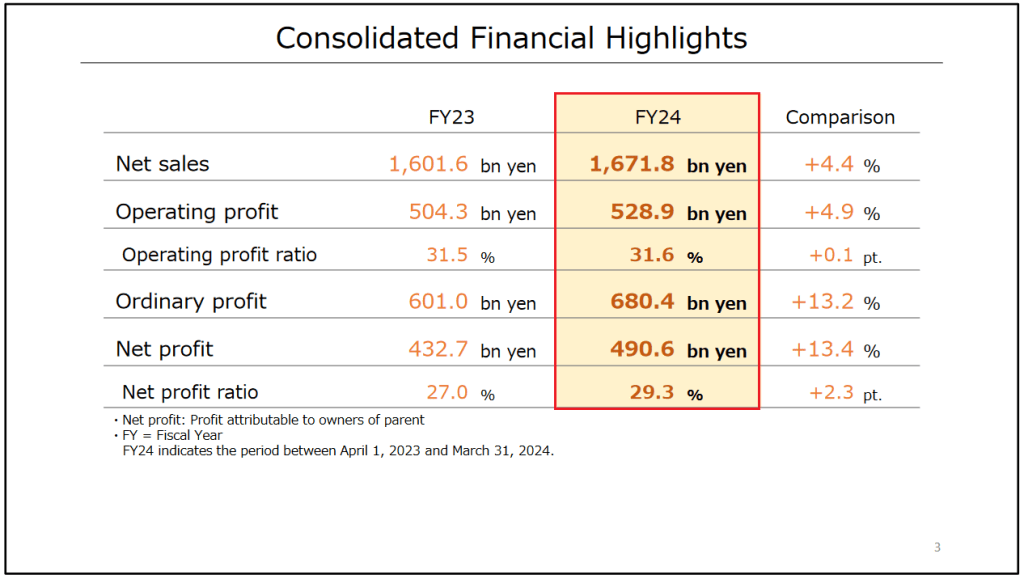

Top level, these are the main stats for Nintendo’s annual results during the year ending March 2024.

Fair warning: Get ready for numbers!

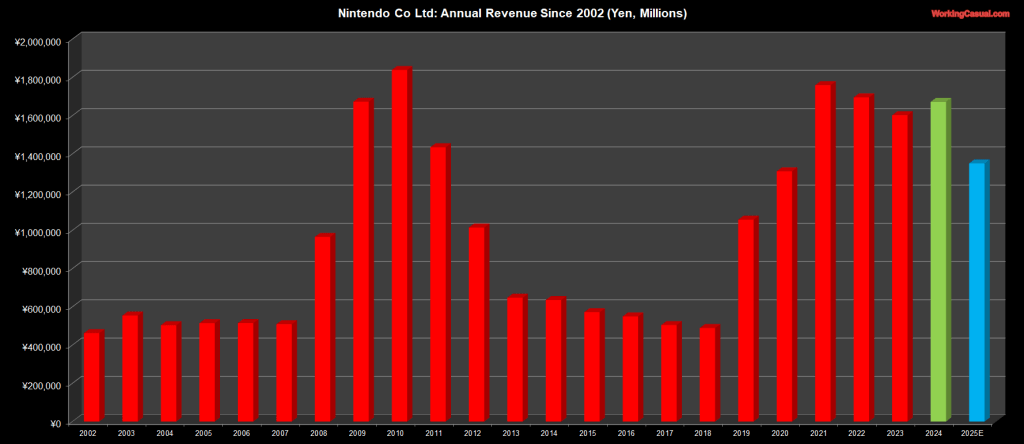

- Revenue up 4% to ¥1.67T ($11.57B).

- Currency impact on revenue of ¥94.4B ($653M).

- Operating profit rose 5% to ¥528B ($3.66B).

- Currency impact on operating profit of ¥35B ($242M).

These were enough to log the third best year in the Switch era by both metrics. While impressive given its latest console’s age, having major releases in the Zelda and Mario franchises alongside a blockbuster animated flick were enough to make up for slowing unit sales.

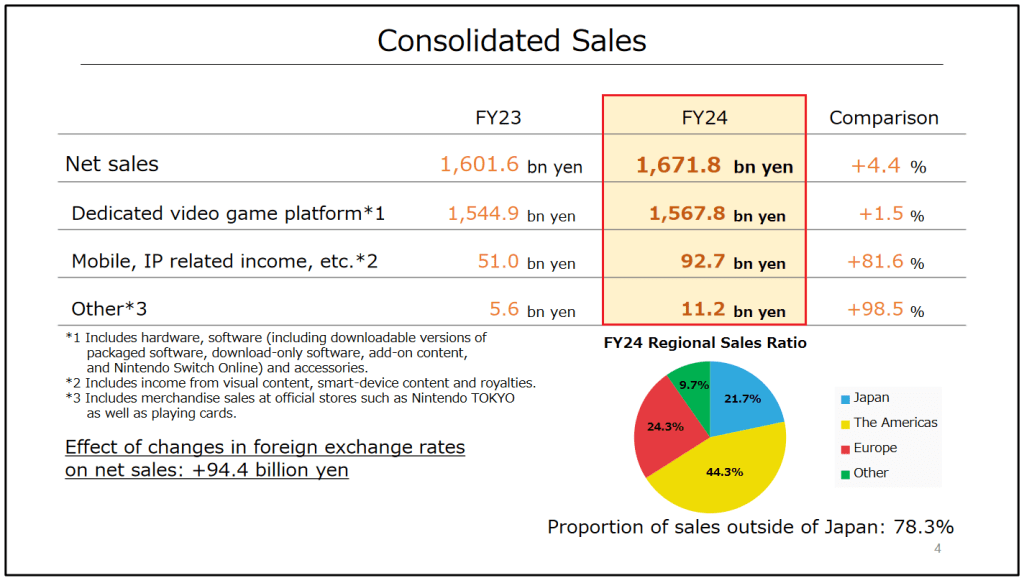

As for product category breakouts:

- Software represented 56% of total sales, up from 54%.

- 81% of software sales were first party, up from 79%.

- The proportion of digital software sales was 50%, up from 48%.

Regional splits were as follows:

- The Americas at 44%, same as last year.

- Europe was 24%, down slightly from 25%.

- Japan reached 22%, compared to 23%.

Underlying a larger-than-usual portion of Nintendo’s growth was its mobile, IP and licensing segment. On the strength of the billion-earning The Super Mario Bros. Movie, sales here rose 82% to ¥11.2B ($77M), plus had the knock-on effect of boosting the popularity of Mario-themed titles in subsequent quarters.

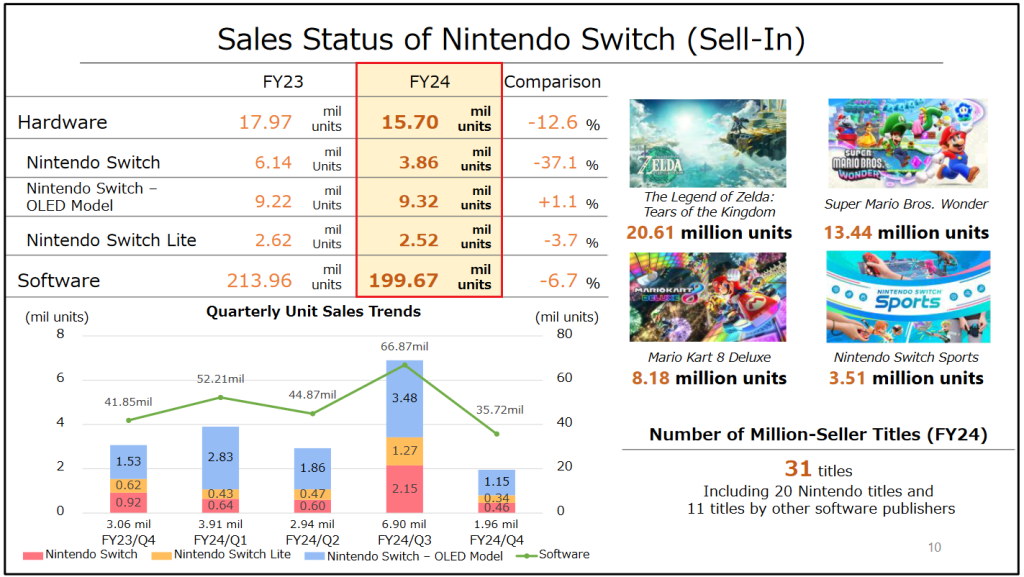

I’ll now reflect on the Hardware portion of the report.

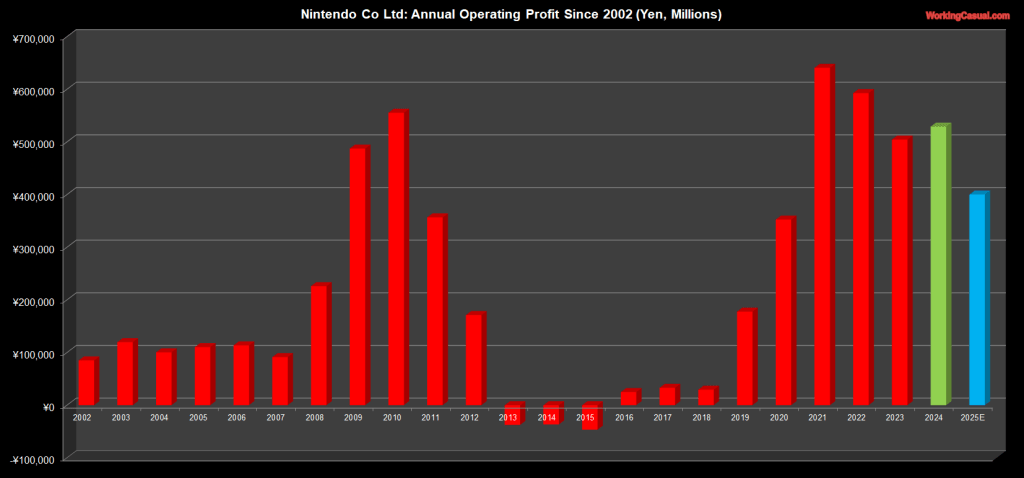

- Switch shipments from January to March were 1.96M, down from 3.06M.

- That brought the year to 15.7M, or 13% lower than fiscal 2023.

- This figure was above management’s revised guidance of 15.5M.

- OLED model was the only one showing growth, up 1% to 9.32M.

While hardware ended up meeting the latest target that executives set, it came in slightly below my personal forecast of 16M. Management called this “stable” for a console of its age.

Lifetime Switch shipments are now 141.32M, thus retaining its spot as the third best-selling gaming console ever.

Prior to this, figures were based on shipments to retail. Nintendo did provide a slide on sell-thru to consumers, charting it out over the Switch’s full life cycle.

Overall, it was the second lowest year for sell-thru other than 2017’s launch. The premium OLED model experienced its highest sell-thru to date, while the base model continued its steady decline, both as expected.

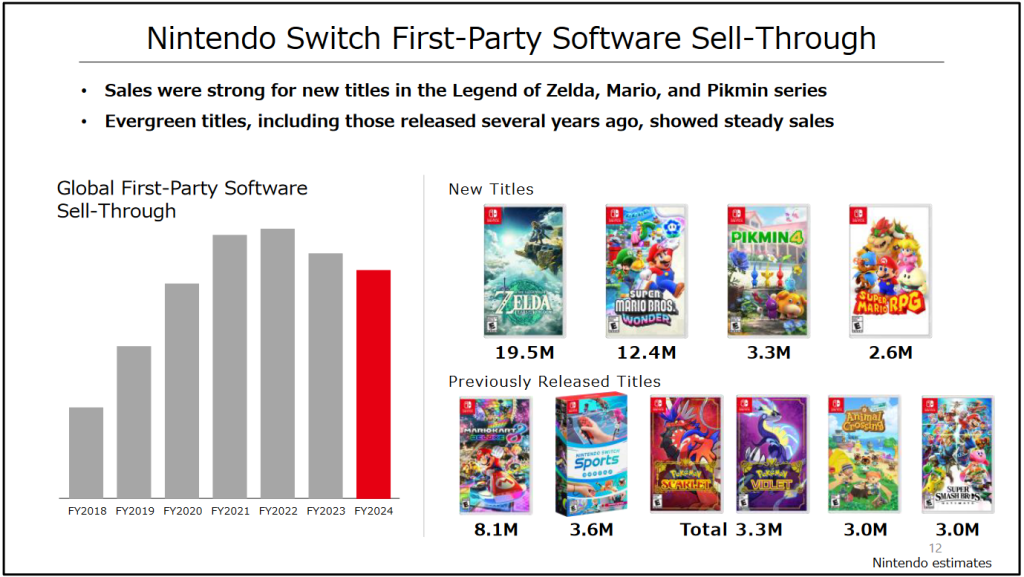

Moving on to Software results for the full year:

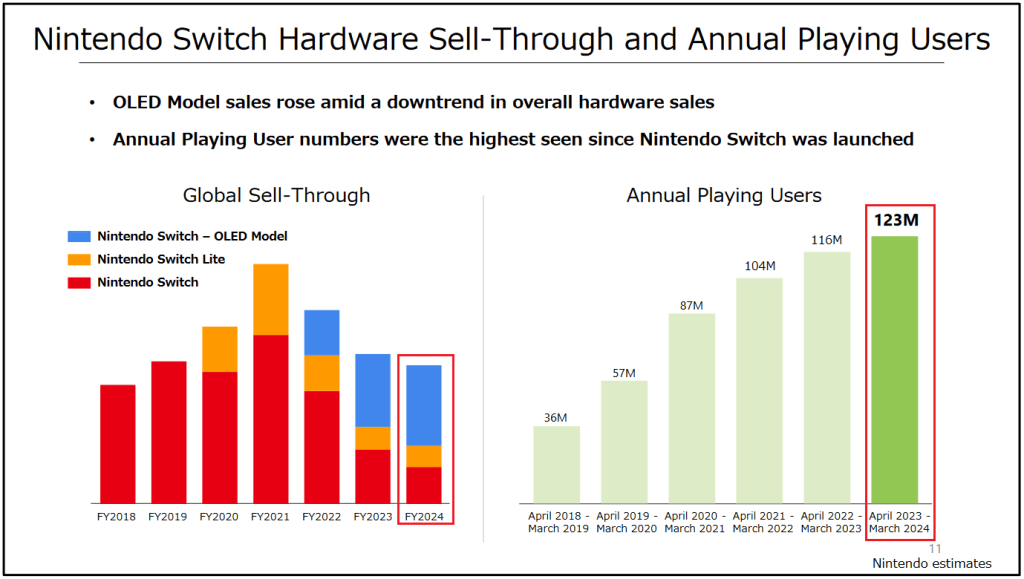

- Game unit shipments declined 7% to 199.67M.

- Even so, that was above the latest target of 190M.

- There were 31 million-sellers. Nintendo produced 20 of them.

- Lifetime Switch software unit sales approached 1.24 billion.

In terms of debuts, February’s Mario vs Donkey Kong remake collected 1.12M units. Additionally, Princess Peach: Showtime! moved over a million in a week, reaching 1.22M by the end of March.

Then there’s the ever-growing list of older and evergreen titles in the portfolio.

- The Legend of Zelda: Tears of the Kingdom saw 20.61M in less than a year.

- Super Mario Bros. Wonder jumped to 13.44M after two quarters.

- July 2023’s Pikmin 4 finished the year at 3.48M.

- Mario Kart 8 Deluxe raced towards 62M lifetime.

Shifting over to software sales as measured by sell-thru to consumers:

- The Legend of Zelda: Tears of the Kingdom at 19.5M.

- Super Mario Bros. Wonder was 12.4M.

- Pikmin 4 eclipsed 3.3M, meaning most of its copies have been purchased.

- November’s Super Mario RPG remake hit 2.6M (out of 3.31M shipped).

“The Legend of Zelda: Tears of the Kingdom, Super Mario Bros. Wonder, and Pikmin 4 all saw sell-through grow at a faster pace than any past titles released on Nintendo Switch in their respective series,” management wrote.

Executives also shared an update to Nintendo’s unique engagement statistic called Annual Playing Users. As of March, it reached an all-time record of 123M, up a million over the prior quarter and 7 million compared to the prior year.

The company might share an update for Switch Online memberships during a corporate briefing in the next few days. The service’s paid membership count was 38M as of September 2023.

It’s another mostly positive annual announcement for Nintendo, showcasing top-line momentum and profitability even as hardware and software units declined. It’s well-known that the market for Switch is saturated, which meant executives had to look for other avenues like film to keep growing, while also supporting the vast audience base with flagship franchises and external partnerships.

What’s to come for the company entering a pivotal time as it plans to bridge the gap between console generations?

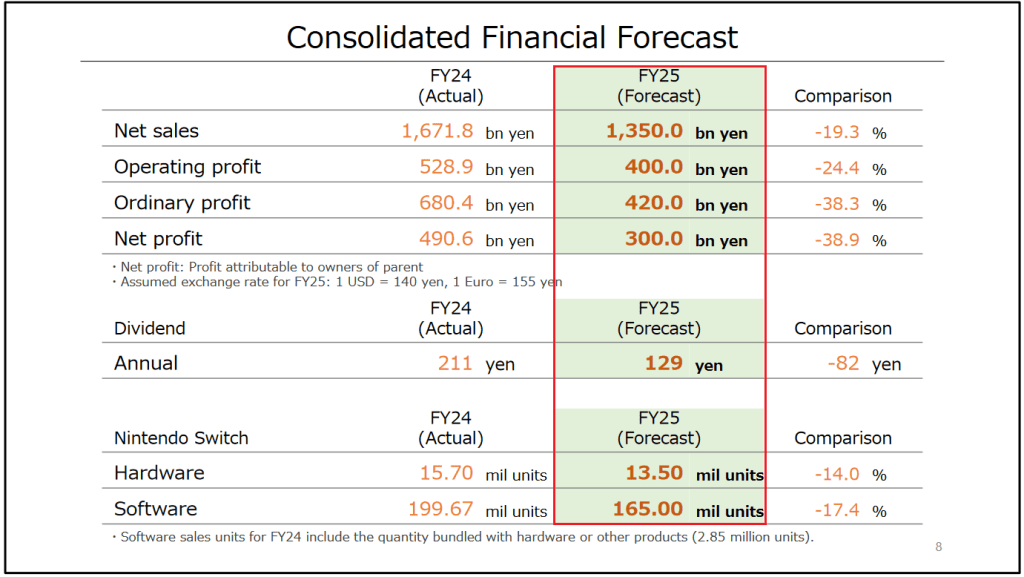

Well, I’ll now run through the headlines for Nintendo’s fiscal 2025 targets:

- Revenue could be down 19% to ¥1.35T ($9.34B).

- Operating profit expected to decline 24% to ¥400B ($2.77B).

- Switch anticipated to ship 13.5M units, down 14%.

- Guidance of 17% lower Switch software units, or 165M.

“Switch has entered its eighth year since launch,” management mentioned. “While it will be challenging to sustain the same sales momentum as before, we will work to maintain high user engagement with the hardware and invigorate the platform so that more consumers continue to play Switch for longer.”

If that last bullet point is achieved:

- Switch will compete for best-selling console ever at roughly 154.82M sold.

- Nintendo DS is in second at 154.02M to date.

- Sony’s PlayStation 2 is currently tops at 155M.

I see the financial forecasts as fine and achievable. On the other hand, Nintendo’s hardware plan is ambitious. Especially given the lighter release slate, chock full of remakes and reissues, and people waiting anxiously for that new announcement. I’m more around 12.5M to 13M, at most.

Speaking of Super Switch, the reveal is officially imminent!

Nintendo President Shuntaro Furukawa took to Twitter to announce that the announcement of Switch’s successor will happen this fiscal year. Though not at a June Direct, which will focus more on the slate of games for the back half of this calendar year.

Based on the guidance and an aggressive target for existing hardware, I expect a full-blown Super Switch reveal to happen around January 2025 with a subsequent launch sometime in or after April 2025.

That about does it for my latest reaction piece. What did you think? Predictions for Super Switch?

Hit me up here or on social media to chat and stay tuned for more coverage of earnings season soon. Thanks for reading!

Note: Comparisons are year-over-year unless otherwise noted.

Exchange rate is based on reported average conversion: US $1 to ¥144.52.

Sources: Company Investor Relations Websites, Nintendo Twitter.

-Dom