I’m here with a rare Friday recap, as everyone knows because they have studied my earnings calendar, of course.

Today in Japan, Nintendo reported results for its first fiscal quarter of 2025.

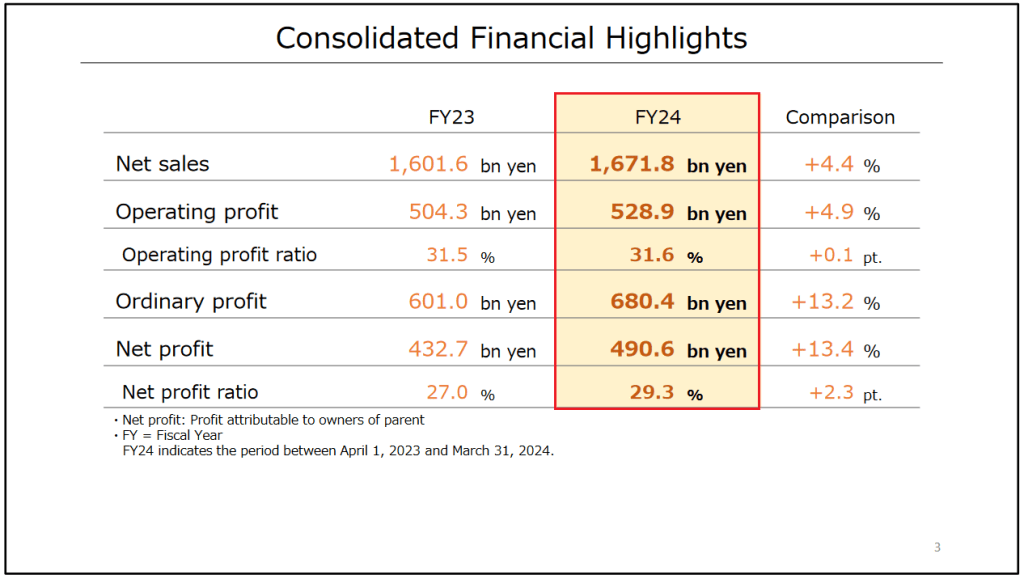

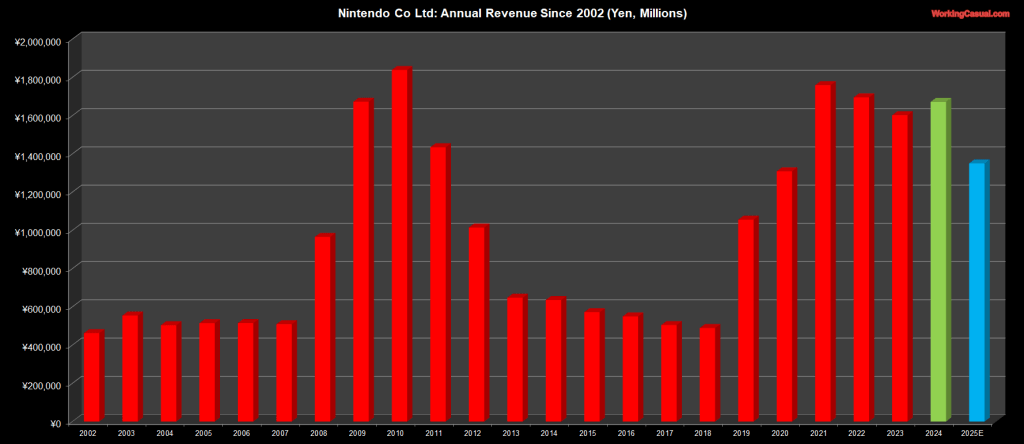

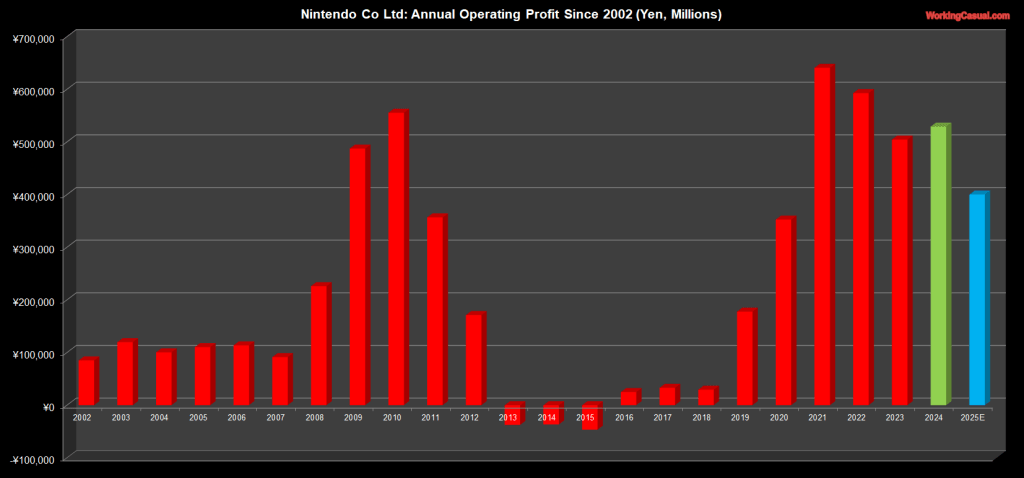

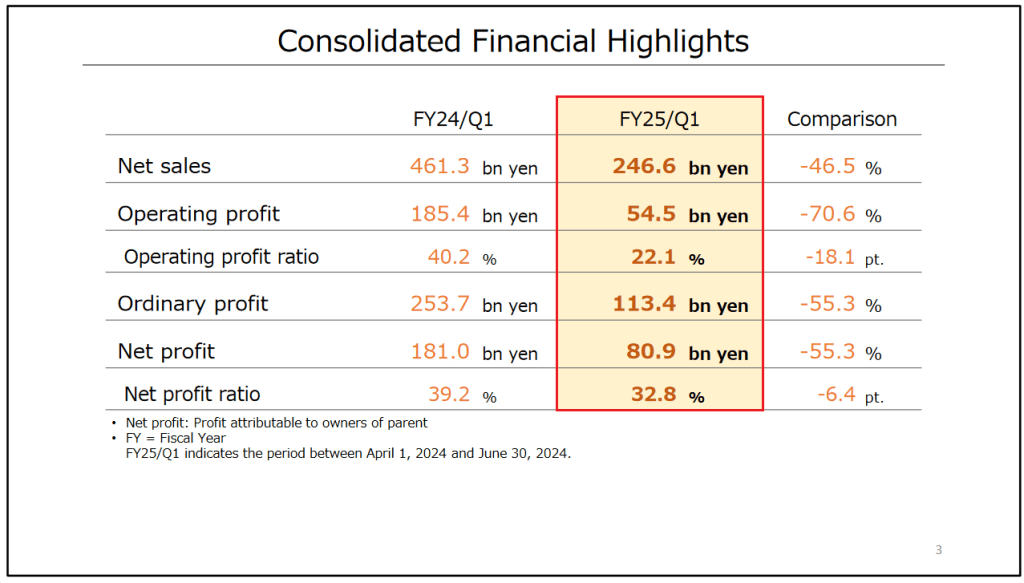

Here’s the headline numbers, during a tricky time where its storied Switch console is entering its final days and management makes moves towards the transition to its successor.

- Revenue and operating profit declined well into double-digit territory.

- The same goes for Switch console shipments, across all versions.

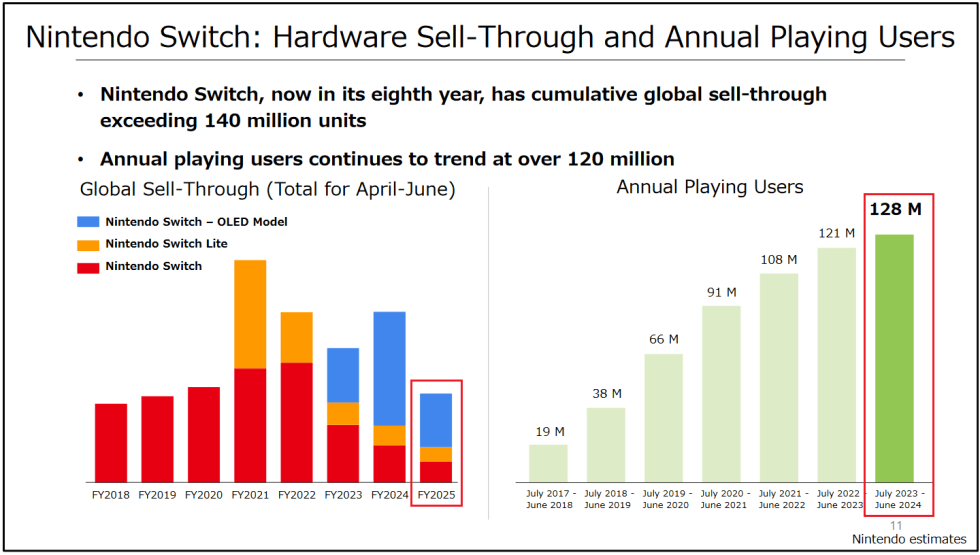

- Switch unit sell-thru to consumers did reach a new lifetime milestone.

- Mario Kart 8 Deluxe sold less than a million units for the first time since 2017.

It’s a tough one all around for the Mario makers, mainly due to a comparison to the company’s best Q1 ever last year due to contributions from a blockbuster film and mainline Zelda launch. Plus, the firm’s expenses are up due to investment in its next generation.

“During the first quarter of the previous fiscal year, unit sales of both hardware and software were extremely high for a first quarter,” management wrote in prepared remarks. “When The Super Mario Bros. Movie energized our dedicated video game platform business and The Legend of Zelda: Tears of the Kingdom was released, together with specially designed hardware based on that title.”

I’ll now look at the figures in more detail then provide a look ahead towards the future, a crucial time for one of gaming’s biggest and most beloved producers.

Taking a broad perspective, the main performance indicators from Nintendo’s most recent quarter ending June 2024 are below.

- Revenue dropped 47% to $1.58B.

- Operating income declined 71% to $350M.

- Research & Development (R&D) expenses rose 18%.

As displayed in the quarterly charts later in this article, this was the lowest Q1 output since fiscal 2020 for both sales and profit. As Nintendo executives alluded in their notes, it’s mainly because there isn’t much driving growth right now, with the main release slate as two legacy titles with a fresh coat of paint while the firm navigates towards a transitory period.

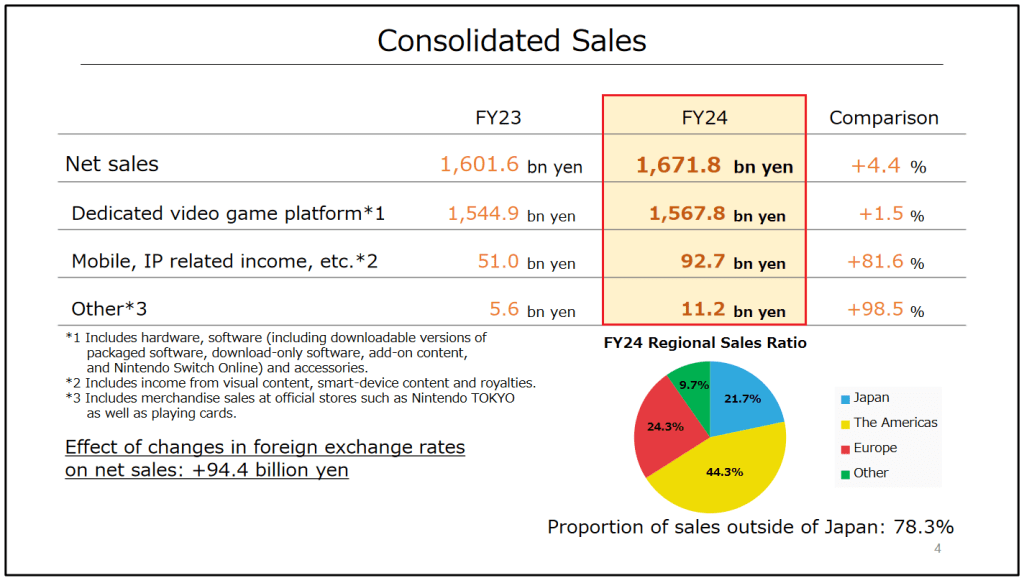

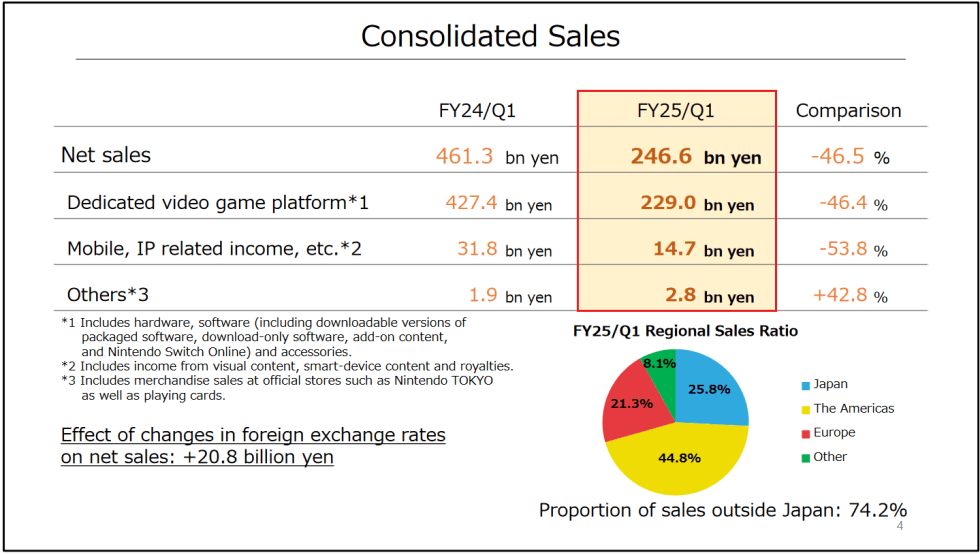

Across product categories, here’s the breakout measured by revenue.

- Software dollar sales made up 50.8%, up slightly from 50.1%.

- Within that, 73% were first-party sales. Last year, it was 89%.

- Digital represented 59% of the total, compared to 47% prior year.

Now, the regional sales ratios for its largest locales.

- The Americas made up 45%, about the same year-on-year.

- Japan saw a sizeable increase, from 20% to 26%.

- Europe dropped to 21%, from 23%.

Due to the massive success of the Mario film starting April 2023, quarterly sales for Nintendo’s mobile and IP-related segment dropped 54% to $94M.

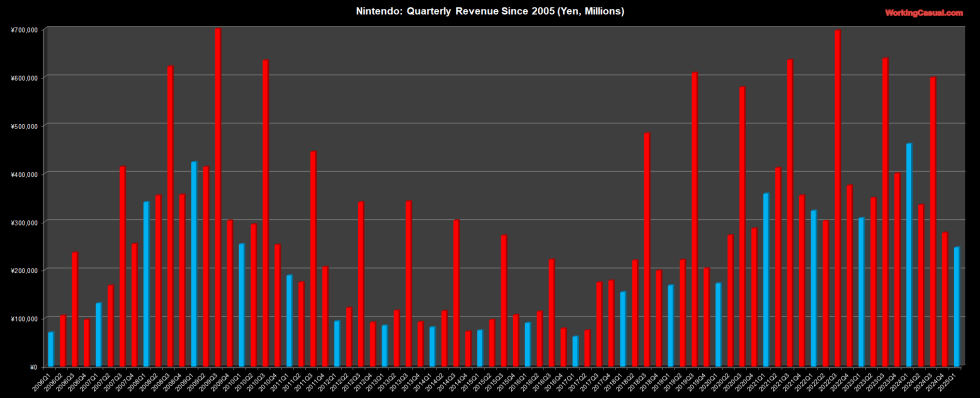

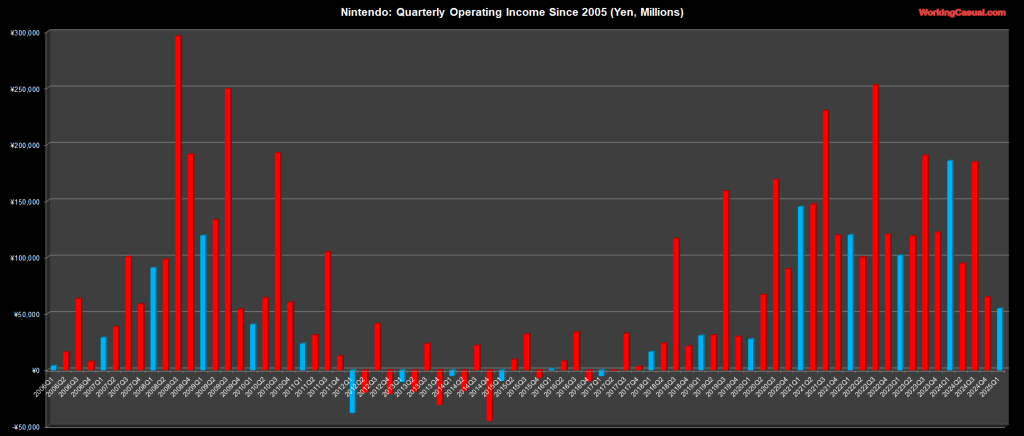

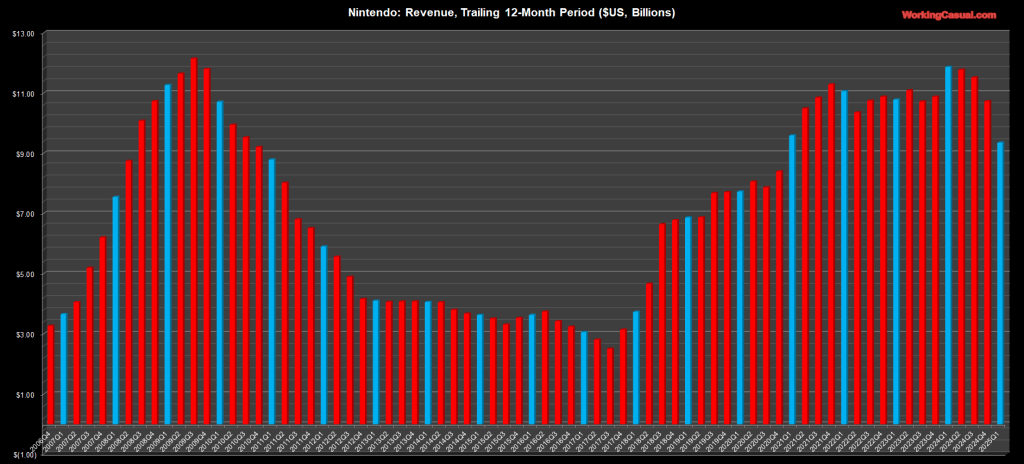

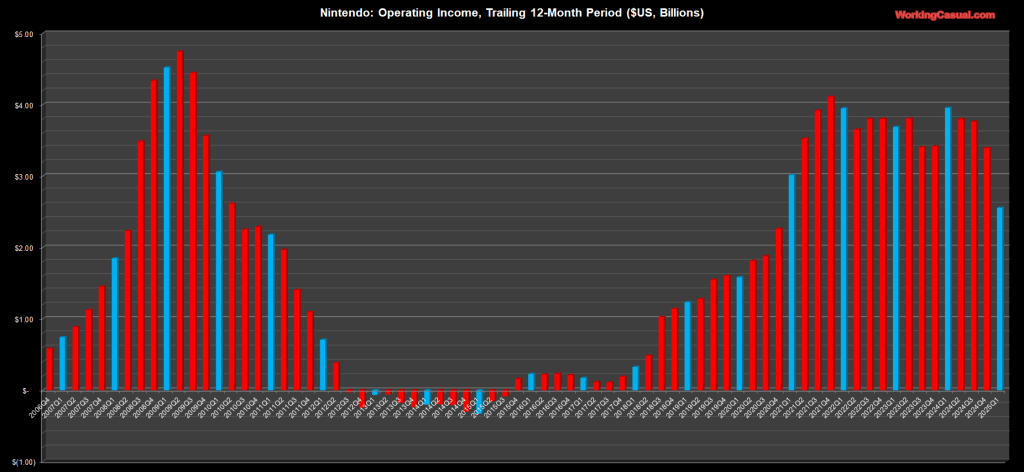

The below charts show sales and profit metrics for both this latest quarter and on a trailing 12-month basis for broader context.

- Annual revenue is currently $9.34B, down from $11.86B.

- Operating profit over that time is $2.55B, compared to $3.95B.

- Both of these are the lowest since late in Fiscal 2020.

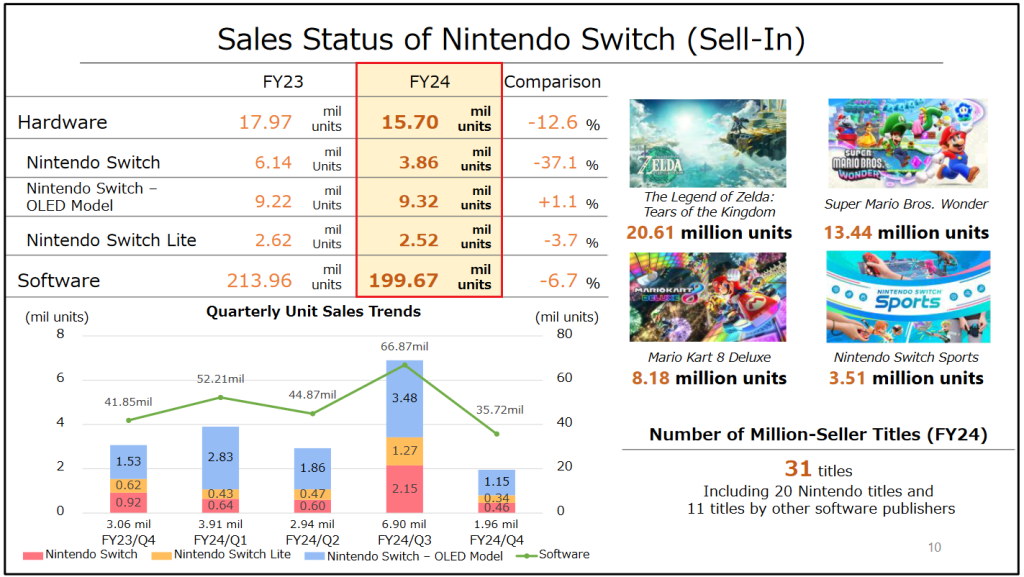

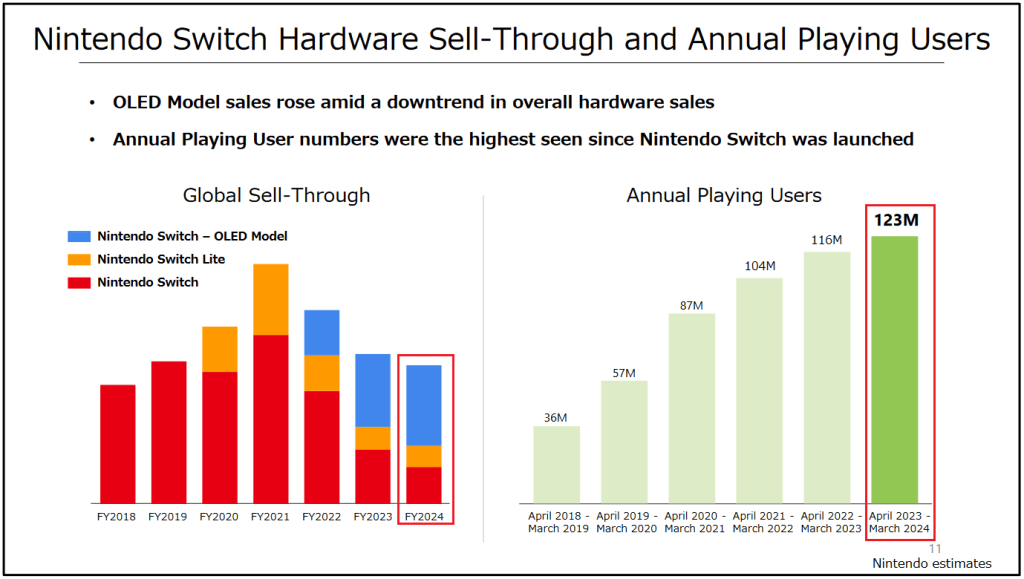

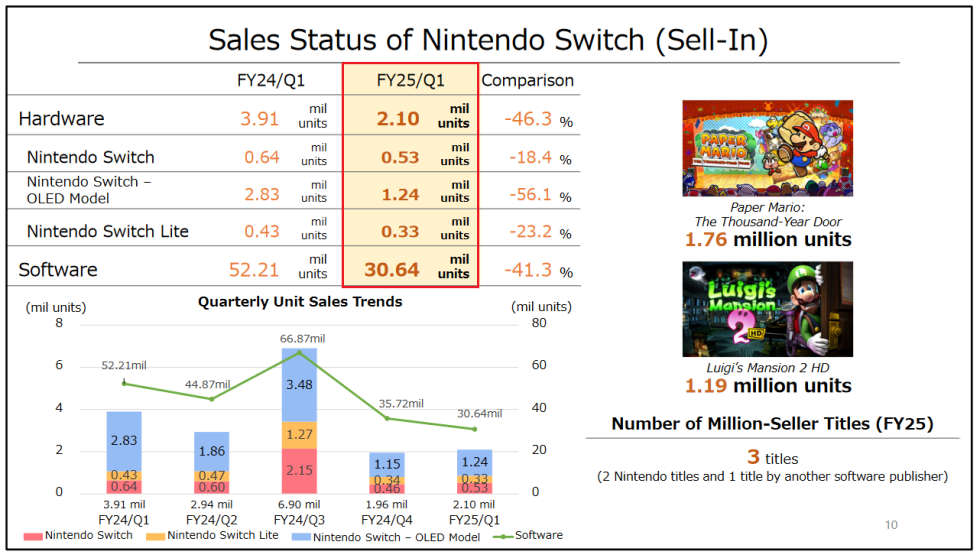

I’ll now shift focus over to the Hardware part of the first quarter report, where Nintendo shares how many units shipped and gives insight into sell-thru to consumers as well.

- Switch saw 2.1M units shipped between April and June 2024.

- That’s down 46%, and the lowest Q1 output since Fiscal 2019.

- OLED experienced the largest drop of 56% to 1.24M.

- Its older Lite version sold 330K, a decline of 23%.

“There were no such special factors in the first quarter of this fiscal year,” executives said. “And with Nintendo Switch now in its eighth year since launch, unit sales of both hardware and software decreased significantly year-on-year.”

This quarterly total brings lifetime Switch shipments to 143.42M, maintaining its spot as the third best-selling console ever, and bringing into question its ability to surpass Nintendo’s own DS (154.02M) and Sony’s PlayStation 2 (155M).

Beyond units shipped, management shared some insight into consumer sell-thru of the hybrid console. Over its life span starting in 2017, Switch has reached an impressive sell-thru milestone of 140M units.

It doesn’t take an enthusiast analyst to explain why a console in its eighth year, without a system seller, is on such a downward trajectory to start this financial year. Even if Nintendo achieves its shipment target, this will be the lightest full year of hardware sales during the Switch era.

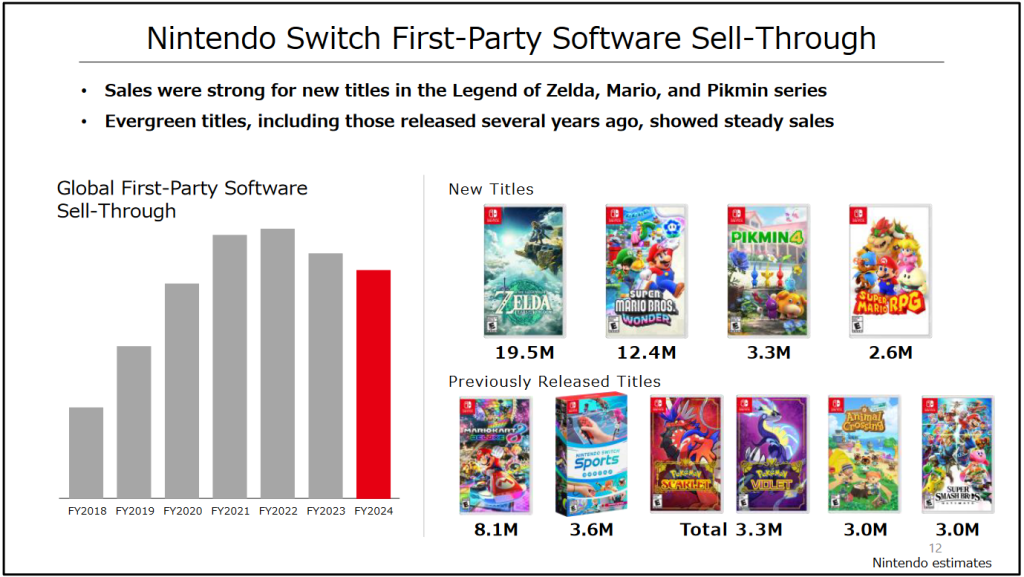

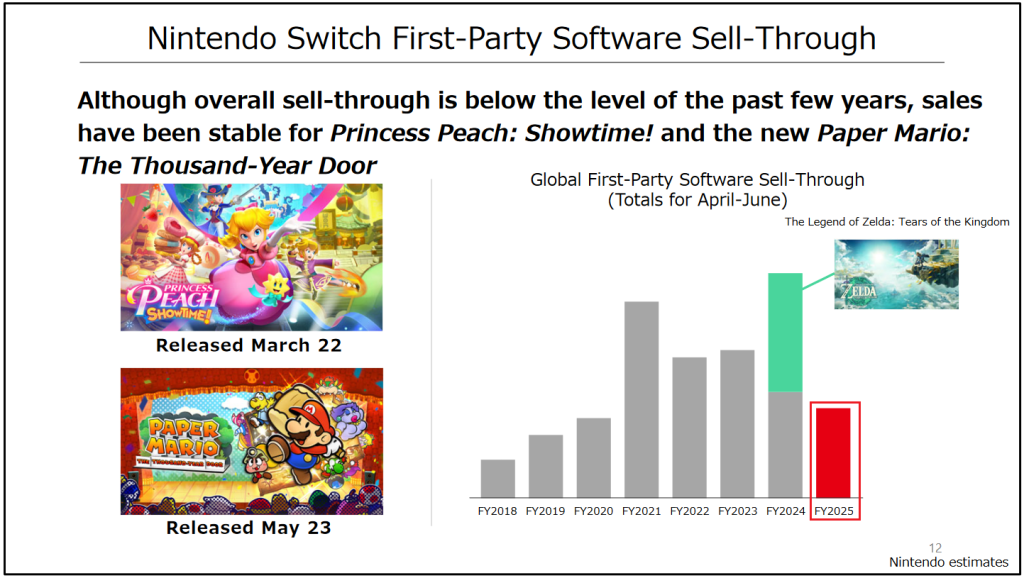

Let’s look at the software categories, including new title performance for Nintendo during the last three months.

- Switch game copies shipped in this period reached 30.64M, down 41% from 52.21M.

- There are currently three million sellers, two of which are Nintendo’s.

- This pushes lifetime Switch software units to nearly 1.27B.

The first million-seller to highlight was Paper Mario: The Thousand–Year Door debuting at 1.76M shipped during the quarter. As a remake, it’s tricky to make comparisons. The GameCube original sold 1.91M units in around three years. The other mainline series game on Switch, Paper Mario: The Origami King, started with 2.82M in 2020.

Luigi’s Mansion 2 HD was that second million-seller, moving 1.19M within just a few days in late June. The base game hit market in 2013 for Nintendo 3DS, selling 750K units in the United States alone within three months. The Switch title Luigi’s Mansion 3 released in October 2019 to 5.37M units its first quarter, albeit with a couple months on sale in that period.

Here’s an observation that shows how the Switch has saturated the market: Neither of those million sellers were called Mario Kart 8 Deluxe. This is the first quarter since back in July to September 2017 during which the console’s best-selling title didn’t hit a million copies sold. It did sell 930K all these years later, quite a strong Q1 compared to most games, and is now approaching 63M lifetime.

In terms of other lifetime milestones, The Legend of Zelda: Breath of the Wild trended above 32M, while Pokémon Scarlet & Violet became the third mainline franchise title to surpass 25M sold.

When it comes to units sold-thru to consumers (rather than shipments), Paper Mario: The Thousand-Year Door topped 1.3M units within six weeks of release, while Princess Peach: Showtime, which originally shipped 1.22M during the prior quarter, also moved past 1.3M by this metric.

Nintendo’s engagement statistics of Annual Playing Users hit a milestone at 128M, up from 121M a year back. The company didn’t share anything on Switch Online memberships, which were 38 million at last count in November 2023.

Nintendo suffered a double whammy as it entered fiscal 2025. This same quarter last year was massive on the strength of its biggest franchises and the Switch continues to show its age with a less compelling line-up than years past, featuring a portfolio titled towards refreshed older titles that aren’t as appealing as brand new entries. Combine that with a console that is present in many a household already, and there isn’t much upside on the financial side right now.

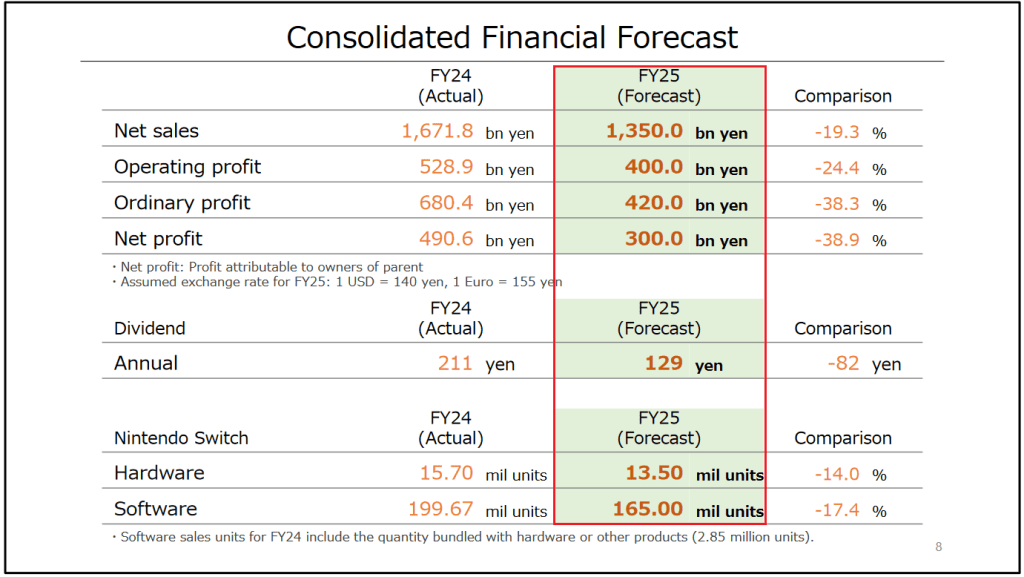

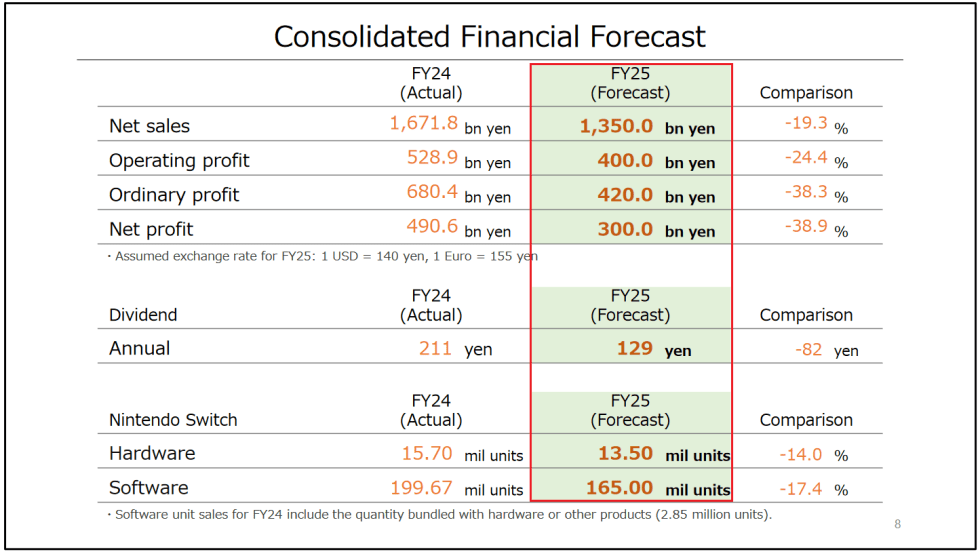

Speaking of that, management maintained its full-year outlook in these latest results. For now, at least.

- Revenue expected down 19% to $8.7B.

- Operating profit could decline 24% to $2.6B.

- Annual Switch units off 14% to 13.5M.

- Software units 17% lower to 165M.

These seem mostly reasonable to me, and I believe Nintendo can achieve all but one of them, even if barely.

It’s the hardware shipment figure where I remain skeptical. In order to hit a 13.5M annual target, Nintendo has to ship 11.4M more Switches over the next 9 months. Last year, when there was both a mainline Zelda and Mario among others to entice new buyers, it moved under 12M across the same nine month span! I’m maintaining a 12.5M to 13M forecast for the year, leaning towards the lower end.

Still, even assuming the lower end, that would put Switch around 154 million lifetime by March 2025. It’s going to be in contention at least for best-selling hardware of all time.

For a console in its home stretch, I’ll admit Nintendo is presenting an appealing line-up leading into the back half of its fiscal year. There’s The Legend of Zelda: Echoes of Wisdom in September, Super Mario Party Jamboree in October then Mario & Luigi: Brothership in November. Donkey Kong Country Returns HD is also slated for January 2025.

Plus, as we’ve entered the latter months of calendar 2024, might we hear about Super Switch? There’s a good chance, however I’m betting it happens right after the Switch’s final holiday season. Full reveal in January, launch April 2025 or later.

That ends the week, and another full recap on the earnings schedule. Hop over to social media for more coverage, and check back soon for more articles. Thanks for stopping by!

Note: Comparisons are year-over-year unless otherwise noted.

Exchange rate is based on reported average conversion: US $1 to ¥155.93.

Sources: Company Investor Relations Websites, Nikkei Asia (Photo Credit).

-Dom