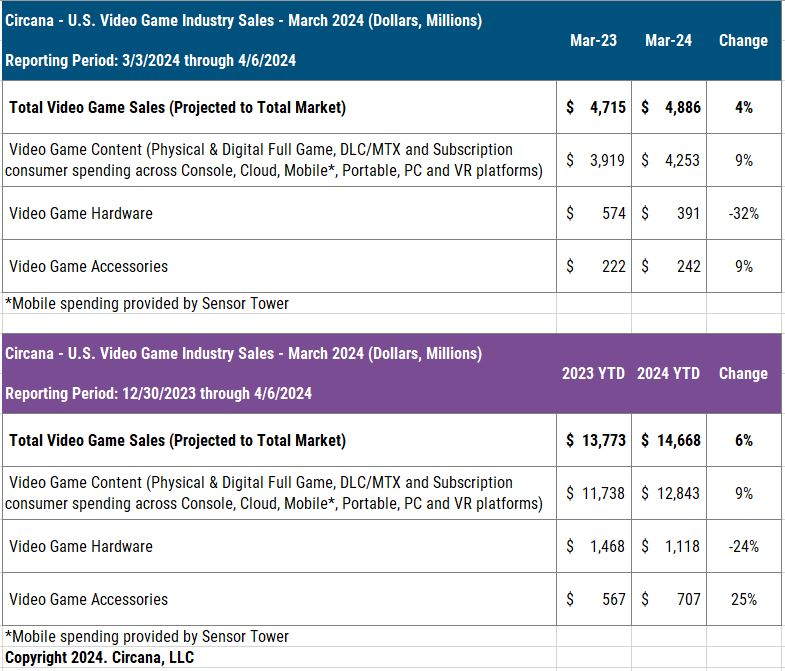

United States Games Industry Sales (March 3rd to April 6th, 2024)

It’s time to cover another U.S. games industry spending report from Circana, this one for the month of March and the end of 2024’s first quarter.

Here’s the quick hits for March consumer spending on video games here in the States:

- Overall spending increased 4% to $4.89 billion.

- Content grew 9% to $4.25 billion.

- Hardware declined 32% to $391 million.

- Accessories moved up 9% to $242 million.

Content, which made up 87% of total spending in March, contributed solid sales momentum for the domestic market, boosted by double-digit mobile growth and a slew of new launches. At the same time, Hardware continued to drag without a huge catalyst or fancy new product offering in sight.

“Mobile’s strong performance was supplemented by a 3% increase in Console Content spend, along with a 2% gain in the PC, Cloud and Non-Console VR Content segment,” said Circana’s Mat Piscatella on Twitter. “Mobile accounted for 89% of the total year-on-year growth in video game content spending during the month.”

Highlighting the announcement was Dragon’s Dogma 2 as the month’s best-selling premium title, highest of the six new releases among the Top 10. Monopoly Go stacked up yet again as mobile’s top grossing game, while Fortnite and Helldivers 2 led platform engagement charts. PlayStation 5 came out on top for console sales by both dollars and units, as it has most months recently.

Scroll down for more on product categories, best sellers, most played games, first quarter results and my predictions for future reports.

In terms of Content, mobile retained its driving force status, growing 15% in March.

On the premium side, Dragon’s Dogma 2 from Capcom debuted at numero uno on the overall chart. It’s already the year’s 3rd best-selling title, and took less than a month to eclipse lifetime sales of 2012’s Dragon’s Dogma and its Dark Arisen expansion combined.

February’s winner Helldivers 2 came in second, solidifying its spot as the top seller for Q1. The latest from Arrowhead Game Studios already ranks 7th ever for Sony-published titles, an extraordinary feat mostly due to its PC success, and it’s been among the most-played games on both PlayStation and PC since its launch.

Perennial sales beast MLB The Show 24 scored a third place start, right around where it usually begins during its launch month, inserting itself as the 5th best-selling title of 2024 to date.

Rise of the Ronin from Koei Tecmo started at #5 in March, and #14 for the Q1 chart. Globally, the publisher claims it’s tracking above Nioh. This tracks here, since that game charted at #9 in the U.S. during its February 2017 launch.

Nintendo’s latest Princess Peach: Showtime! slotted in 6th, excluding digital, while Sega’s Unicorn Overlord had a fantastic start in 8th. Rounding out the new titles among the top ranks was Take-Two’s WWE 2K 24 in 9th, again without its digital portion included.

As measured by monthly active users, Fortnite was the most played on both PlayStation 5 and Xbox Series X|S, followed by Call of Duty and Grand Theft Auto V. On the PC side, it was Helldivers 2, Counter-Strike 2 and Baldur’s Gate 3. Also, huge shout out to poker roguelite Balatro in 4th on PC!

Check below for March’s best-seller ranks for premium and mobile.

Top-Selling Premium Games of March 2024, U.S. (Physical & Digital Dollar Sales):

- Dragon’s Dogma 2

- Helldivers 2

- MLB The Show 24^

- Call of Duty: Modern Warfare 3

- Rise of the Ronin

- Princess Peach: Showtime!*

- Final Fantasy VII: Rebirth

- Unicorn Overlord

- WWE 2K24*

- Hogwarts Legacy

- Madden NFL 24

- EA Sports FC 24

- Minecraft

- Horizon Forbidden West

- Tekken 8

- Rainbow Six Siege

- Elden Ring

- Mario Kart 8*

- Marvel’s Spider-Man 2

- Mortal Kombat 1

Top-Selling Mobile Games of March 2024, U.S.:

- MONOPOLY GO!

- Royal Match

- Roblox

- Candy Crush Saga

- Coin Master

- Whiteout Survival

- Last War Survival

- Pokémon Go

- Township

- Clash of Clans

Here’s the scoop on Hardware’s tough time last month:

- All three major console families saw spending decline over 30%.

- PlayStation 5 was the leader by both units and dollars.

- The digital edition of PlayStation 5 contributed 39% of unit sales.

- Nintendo Switch was #2 measured by units.

- Xbox Series X|S secured runner-up by dollars.

Flipping over to Accessories as a segment:

- Spending moved up almost double-digits.

- The headset and headphone sub-segment rose 8%.

- PlayStation 5’s Dual Sense Edge was March’s best seller.

- Sony’s high-end controller was also Q1’s winner.

Expanding to results for the January to March 2024 time frame:

- Overall spending grew 6% to $14.67 billion.

- Content increased 9% to $12.84 billion.

- Hardware dropped 24% to $1.12 billion

- Accessories jumped up 25% to $707 million.

Within premium gaming, Helldivers 2 was the quarter’s top earner. That was followed by Call of Duty and newcomer Dragon’s Dogma 2. Other standouts include Final Fantasy VII: Rebirth in 4th, Persona 3 Reload in 9th, last year’s winner Hogwarts Legacy at #10.

Similar to March, PlayStation 5 was the leading console in Q1 by units and revenue while Nintendo Switch came in the second spot by units, and Xbox Series X|S slotted at #2 by dollars.

“Total U.S. Video Game spending being up 6% in Q1 2024 despite a 24% drop in hardware spending.. shows how diversification has made the market more resilient,” said Piscatella.

Here’s the list of best-selling premium titles for 2024 to date.

Top-Selling Premium Games of Q1 2024, U.S. (Physical & Digital Dollar Sales):

- Helldivers 2

- Call of Duty: Modern Warfare 3

- Dragon’s Dogma 2

- Final Fantasy VII: Rebirth

- MLB The Show 24^

- Tekken 8

- Suicide Squad Kill the Justice League

- Madden NFL 24

- Persona 3 Reload

- Hogwarts Legacy

- EA Sports FC 24

- Skull & Bones

- Marvel’s Spider-Man 2

- Rise of the Ronin

- Super Mario Bros. Wonder*

- Elden Ring

- Minecraft

- Like a Dragon: Infinite Wealth

- The Last of Us Part 2

- Mortal Kombat 1

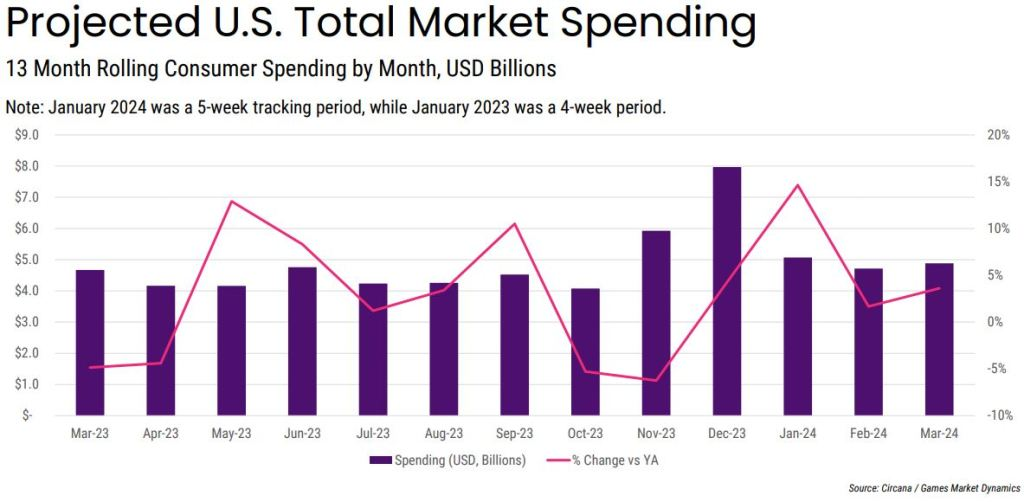

In summary, March and 2024’s first quarter had comparable dynamics when it comes to category results, where both Content and Accessories went up, notably bolstered by mobile and surprise launches in previously-unheralded franchises like Helldivers and Dragon’s Dogma, while Hardware faces a number of headwinds and can’t find a catalyst to growth right now.

Looking ahead, I’ll now run through my thoughts on April and a quick mention of my annual forecast.

- I’m thinking we’ll see total April sales rise in the single-digits.

- Content will go up, more impacted by older titles rather than new launches.

- I expect Hardware to decline in the low to mid double-digits.

I certainly expect there to be fewer new titles in April ranking high on the premium list, compared to more than half of the Top 10 this past March, because there weren’t many triple-A flagships.

The controversial Stellar Blade has a solid chance at competing for a Top 5 debut, even being a PlayStation 5 exclusive. Otherwise, we’ll likely see movement for Microsoft-owned brands. This includes Sea of Thieves hitting a new audience and Bethesda games creeping back into the Top 20 or higher due to the uber-popularity of Amazon’s Fallout series, which already attracted 65 million viewers according to Variety.

In terms of an annual forecast for all of 2024, Piscatella is maintaining his guess for a 2% drop in spending. Personally, I’ll maintain my latest forecast of “virtually flat to slightly down” based on signs pointing to the more enthusiast PlayStation 5 Pro hitting market instead of a Super Nintendo Switch, the latter of which would drive Hardware to much better performance and have a system-selling title alongside it.

That’s it for March and the first quarter. Time flies. I recommend reading Piscatella’s thread here on social media. I’ll be back next week with more earnings season coverage. Thanks for reading!

Note: Comparisons are year-over-year unless otherwise noted.

*Digital Sales Not Included

^Xbox & Nintendo Digital Sales Not Included.

Sources: Circana, Koei Tecmo, Variety.

-Dom