It has arrived.

No, not the 2024 Olympics. Although it’s arguably just as important. Earnings season is here!

Much like the Summer games, there’s a rich tradition around this time. It’s when I draft up and post a calendar with all the dates on which companies across gaming, media and technology provide an update on their businesses, and often look ahead to future prospects.

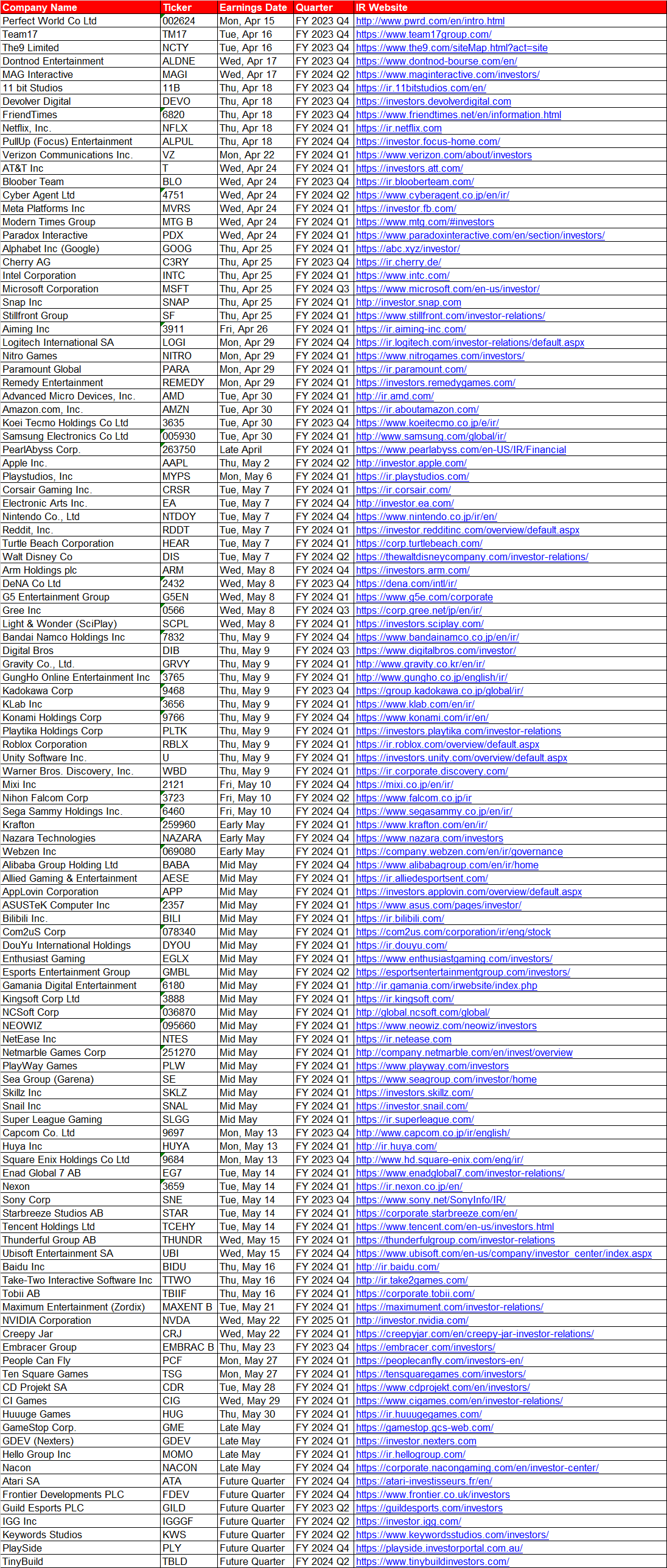

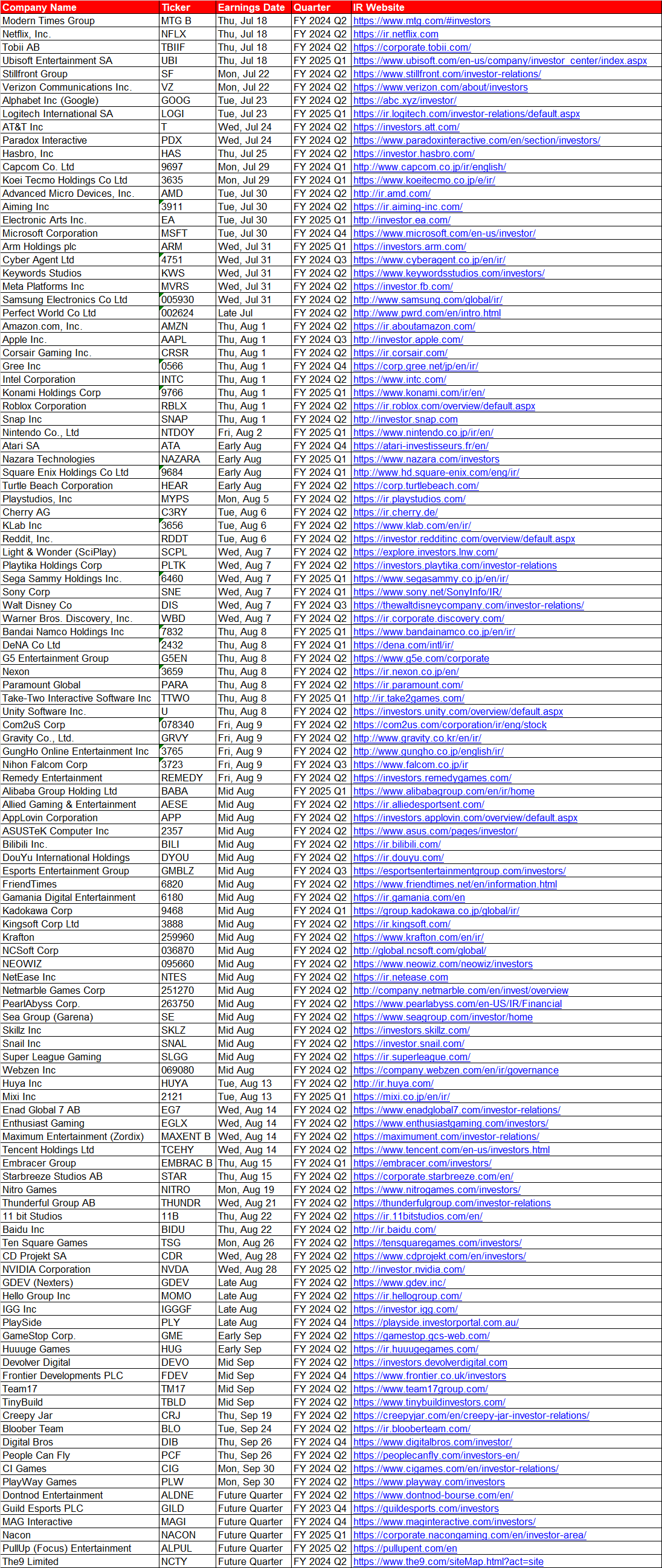

The list is a robust one, steadily approaching 120 companies strong. For added benefit, I’ve added the date and fiscal quarter associated with the latest report, along with investor websites for easy access. Note that all dates are listed in local time zones.

Quick note around the initial public offering of Shift Up, the South Korean developer of 2024’s hottest, and most controversial for certain crowds, titles Stellar Blade. I’ll have the company included next quarter since I didn’t see concrete info right now.

Check below for a full Google Sheets link, then descriptions of three key companies to watch in the upcoming weeks. Enjoy, and be well!

Working Casual Earnings Calendar Jul & Aug 2024: Gaming, Media & Tech Companies

Electronic Arts (EA): Tuesday, July 30th

The mention of the American publisher is mainly an excuse to talk about EA Sports College Football 25, which technically launched in July after its Q1 of 2025 time frame ended. This return to the glory days of college football video games, the first franchise game in over a decade, is showing great early success, selling-thru 2.2 million copies of its deluxe edition alone! I’d love if Electronic Arts shared more details around its kick-off, including overall unit sales or player stats, plus if there’s any upside impact to its current guidance. I’m estimating 7 million units, if not more, by the time the fiscal year ends in March 2025. Talk about a score.

Nintendo Co., Ltd (NTDOY): Friday, August 2nd

It’s a rare Friday announcement for Nintendo when it shares first quarter performance early in August. Sure, I’ll be interested to learn more about early momentum for new old games like May’s Paper Mario: The Thousand Year Door and Luigi’s Mansion 2 HD, a late June launch, or any updates around annual hardware guidance (which I don’t expect just yet). The Japanese company’s inclusion on this list is mostly obligatory in light of this year being the Switch’s swan song, and the impending reveal of its successor being firmly on the horizon. Last quarter, President Shuntaro Furukawa shared the sweetest of morsels that the Super Switch would be revealed by March 2025. Might he bless us with another taste this time as well?

Nexon (3659): Thursday, August 8th

The Seoul-based publisher, which reports second quarter 2024 numbers in a couple weeks, isn’t as widely known as certain peers, focusing more on regional PC and mobile titles. It’s one of many making big investments related to international expansion, an effort that has seemingly produced a breakout global hit with The First Descendant. The action shlooter attracted an impressive 10 million players during its first week earlier this month, and I assume a larger proportion of them are outside the Asia Pacific region compared to its other products. The question is how this translates to the bottom line, considering the title is free-to-play. Now, it also features hundred dollar cosmetics, and the model can be highly lucrative if the player base is engaged, which appears to be the case here.

Sources: Company Investor Relations Websites.

-Dom