The start of a new earnings season, complete with my usual calendar, means it’s time to start up recaps as well.

I’m going to try something new and tighten up these recap articles!

More concise, same great quality. I hope.

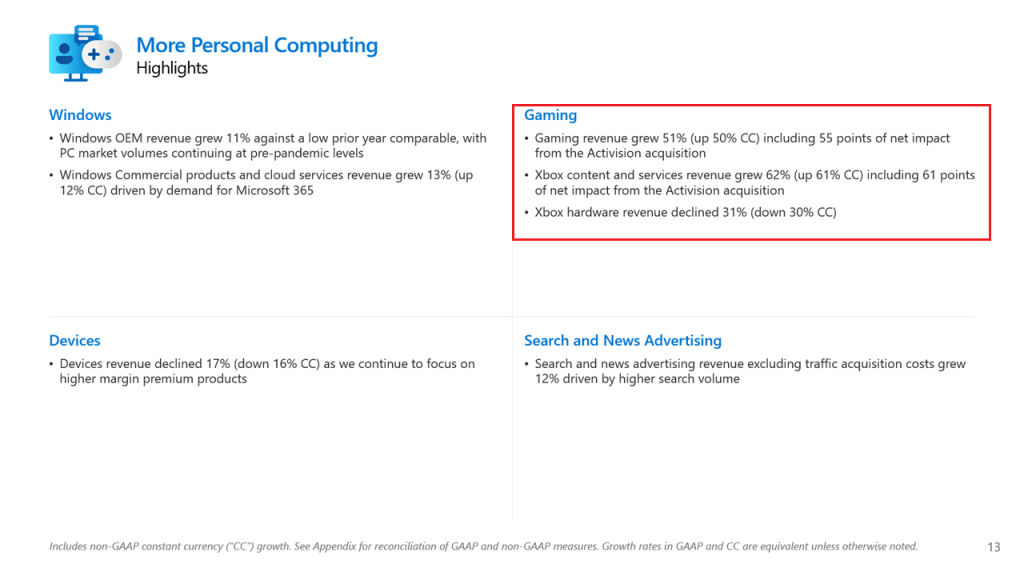

Today, that means covering Microsoft’s recent 2024 Q3 results. I’ll focus mostly on Xbox during this January to March time frame, where there was major sales growth solely due to the impact from Activision Blizzard, as other areas within gaming declined including things like content, subscription and hardware offerings.

Still, Xbox segment sales outpaced guidance, mainly due to out-performance of Call of Duty.

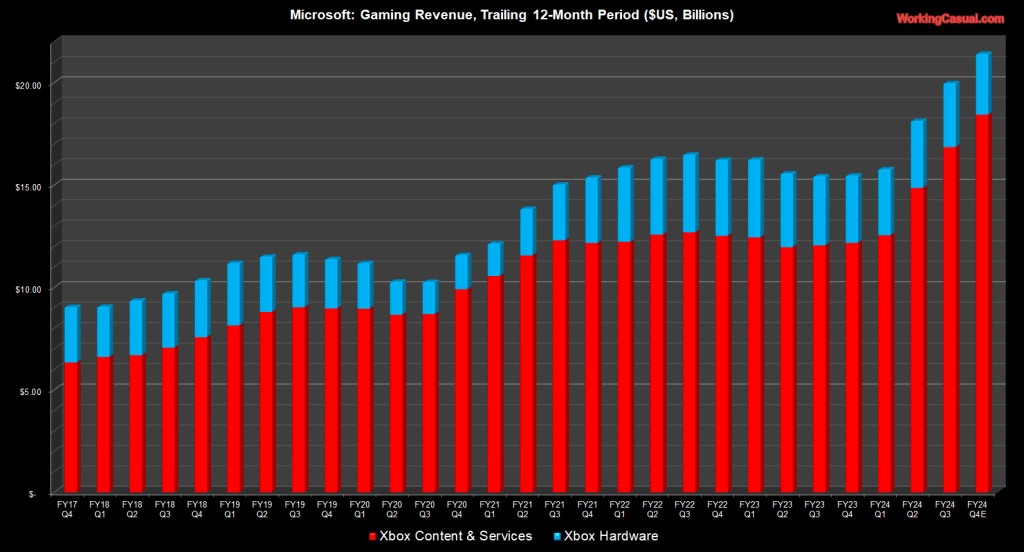

Microsoft’s gaming division also hit a major milestone this quarter. Feeling the boost from the acquisition being included for two quarters now, annualized Xbox sales reached $20 billion for the first time ever.

I mean, this is why Microsoft spent all that dough. Plus, executives expect this to continue in the immediate future, according to guidance I’ll highlight later in this article, as that annual sales number is likely to move above $21 billion to close the fiscal year.

Now I’ll move right into a rundown of the numbers and a look ahead into the future of a somewhat shaky time for Xbox’s output.

Here’s a quick summary of Microsoft’s quarterly gaming sales, as shown in the slides above.

- Q3 revenue rose 51% to upwards of $5.45 billion.

- This was above management’s, and my, expectations.

- It’s an all-time Q3 record, and Xbox’s second best quarter ever.

- Out of that percentage gain, 55% was due to ActiBlizz impact.

- Implies all other areas like Xbox, Bethesda etc saw a decline of 4%.

These quarterly sales move gaming back to fourth place in terms of Microsoft’s major product categories, trailing Windows at $5.93 billion.

Expanding now to current annualized Xbox revenue to get a broader sense of the business:

- Overall annual gaming revenue is $19.97 billion.

- Compare that to $18.13 billion as of last quarter.

- The chart in the above gallery shows these in context.

I’ve long written about how this was the strategy around Microsoft’s merger and acquisition activity, to push past the $20 billion per year mark and approach its largest peers, like Sony and even Tencent, especially by leveraging ongoing services and breaking more into mobile.

Which is why I don’t think Microsoft is done buying, even after spending so much on the world’s largest formerly third party publisher.

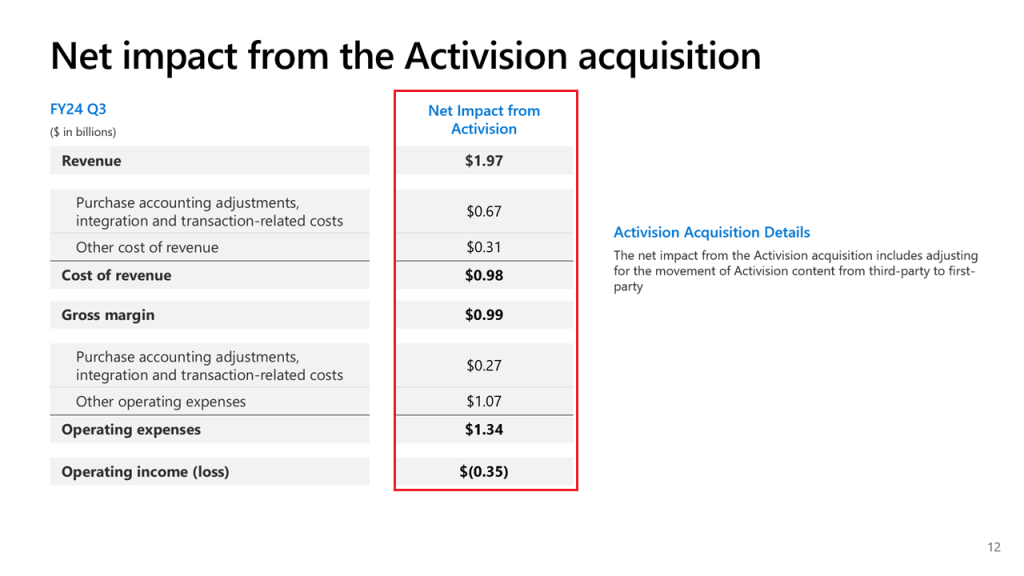

Similar to my earlier coverage of Xbox, I’ll mention that Microsoft gives limited visibility into the profitability, or lack thereof, of its gaming business. Two points on that:

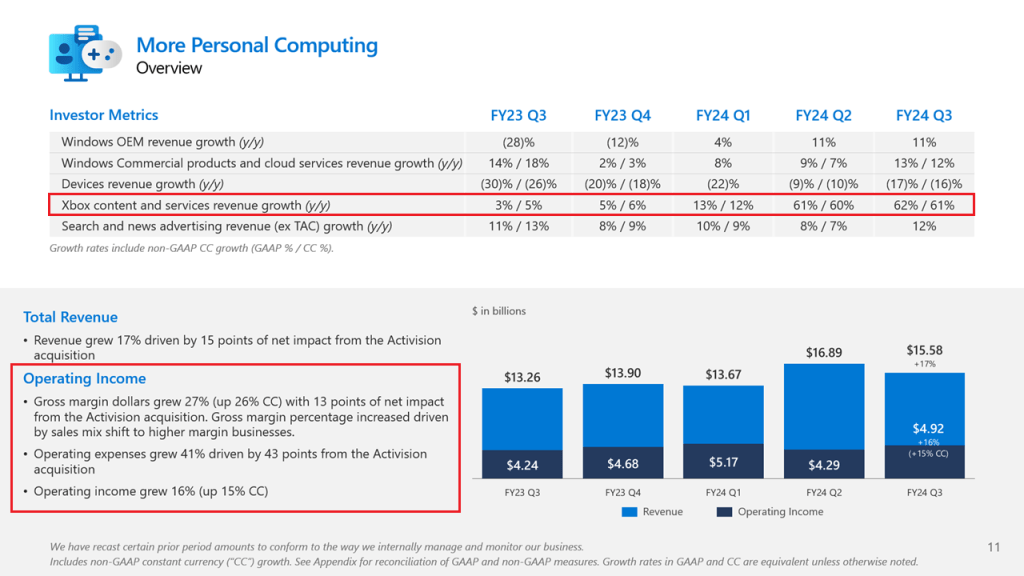

- The More Personal Computing (MPC) segment saw operating profit rise 16% to $4.92 billion.

- The ActiBlizz deal boosted expenses, as its net impact in Q3 was an operating loss of $350 million.

This implies that Xbox, despite seeing a big top-line boost, was likely less profitable this quarter.

Here’s where I’ll highlight the underlying dynamics, by way of discussing product categories.

First up is the larger of the two, Xbox Content & Services (Xbox C&S):

- Q3 Xbox C&S revenue increased 62% to $5.03 billion.

- Same as games revenue, this is also a Q3 record and second best ever.

- ActiBlizz growth contribution was 61%, thus a 1% gain for everything else.

Then, on an annual basis:

- Current annual Xbox C&S revenue is $16.86 billion, or 84% of the total.

- That’s up from $14.86 billion last quarter, when it was 82% of the total.

On the flip side, Xbox Hardware had another tough time, without much to drive its fundamentals right now, as lower unit sales weren’t enough to offset gains from higher pricing:

- Q3 Xbox Hardware revenue declined 31% to $350 million.

- The lowest 3rd quarter dollar sales of the Xbox Series X|S generation.

Looking at the last 12 months:

- At present, Xbox Hardware annual sales are $3.11 billion.

- That’s down from $3.27 billion sequentially, and $3.37 billion last year.

Since Microsoft doesn’t tell us anything about lifetime Xbox Series X|S unit sales, I’ll keep up with my guesstimates.

- I had the family at 29 million to 29.5 million last quarter.

- It’s now likely hovering right around the 30 million milestone.

- I forecast it moved 700K to 800K in the three months ending March.

- Which lands it around 29.7 million to 30.3 million to date.

When it comes to supplemental stats like engagement, player counts etc, Xbox management didn’t have much to say.

Chief Executive Officer (CEO) Satya Nadella did note the following on the firm’s conference call:

- Q3 records for “game streaming hours, console usage and monthly active devices.”

- The first ActiBlizz title on Game Pass Diablo IV was one of the service’s biggest launches.

- Players clocked over 10 million hours during its first 10 days.

- This month, Xbox had 7 games among the Top 25 on the PlayStation store.

Which is a distinct lack of specifics, especially as it relates to Game Pass subscribers or total monthly active users, which unfortunately is a common theme here from management.

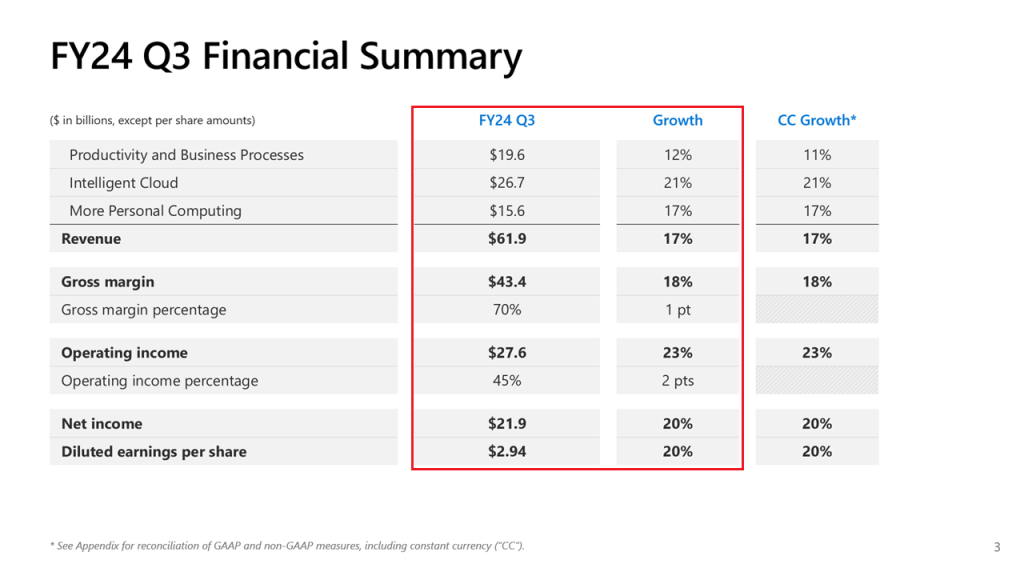

Before closing out, I’ll mention Microsoft’s overall results.

- Company revenue jumped 17% to $61.9 billion.

- Operating profit moved up 23% to $27.6 billion.

- Microsoft Cloud sales increased 23% to $35.1 billion.

Slipping into the future, management provided guidance for the final quarter of fiscal year 2024.

Here are the expectations shared by Chief Financial Officer (CFO) Amy Hood for Q4 gaming performance.

- Total gaming revenue growth in the low to mid-40s.

- 50 points of that via ActiBlizz impact.

- Xbox C&S expected to grow in the high 50s.

- 60 points there from ActiBlizz, thus implying everything else will be down 10%.

- Xbox Hardware will “decline again.” Based on my math, it will be down 24%.

Using these to make certain assumptions, that translates to the following in dollar terms:

- Total gaming revenue around $5 billion.

- Xbox C&S revenue upwards of $4.55 billion.

- Xbox Hardware hitting $450 million.

These feel right to me, with upside for content based on Senua’s Saga: Hellblade II launching in May, certain games like Sea of Thieves accessing additional audiences and a good effect from Amazon’s Fallout show (which is awesome).

Really, it’s going to go as ActiBlizz games go, notably as they are added to Game Pass.

If Xbox hits these targets, it would shatter a record for fiscal year sales, approaching $21.5 billion. For comparison, this number was at $15.5 billion at the end of fiscal 2023!

I hope you enjoyed the new format experiment, where I’m balancing analysis with word count to make it easier to follow and fun to read.

I’ll be back soon with more articles, and feel free to reach out on social media in the interim. Thanks for reading. Until next time, be well!

Note: Comparisons are year-over-year unless otherwise noted.

Sources: Company Investor Relations Websites, Xbox Wire.

-Dom