According to the earnings calendar, it’s time for another recap!

This time I’ll be covering both Q4 and annual results for Microsoft, with a specific rundown on the Gaming business, which is currently experiencing growth via acquisition and facing much uncertainty around certain elements of its current strategy.

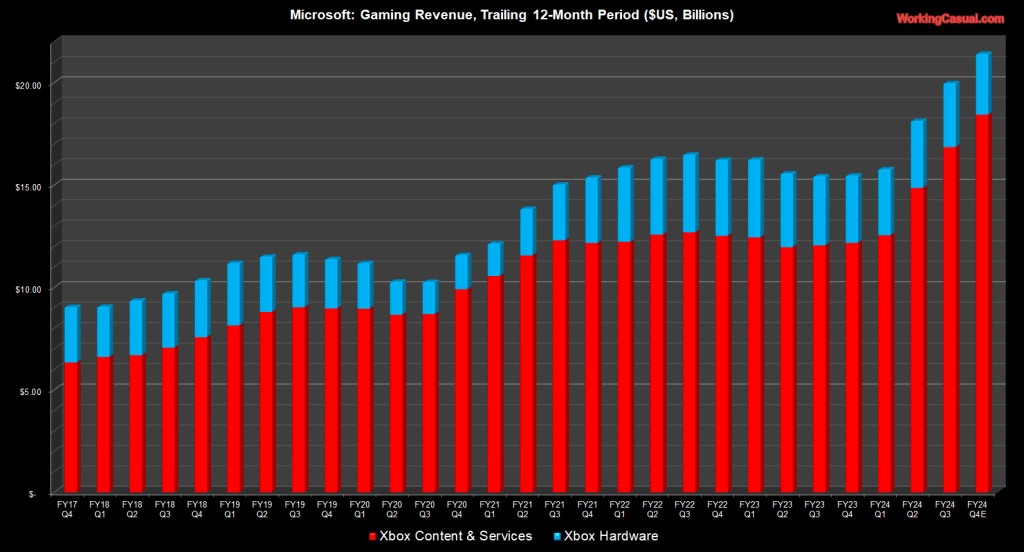

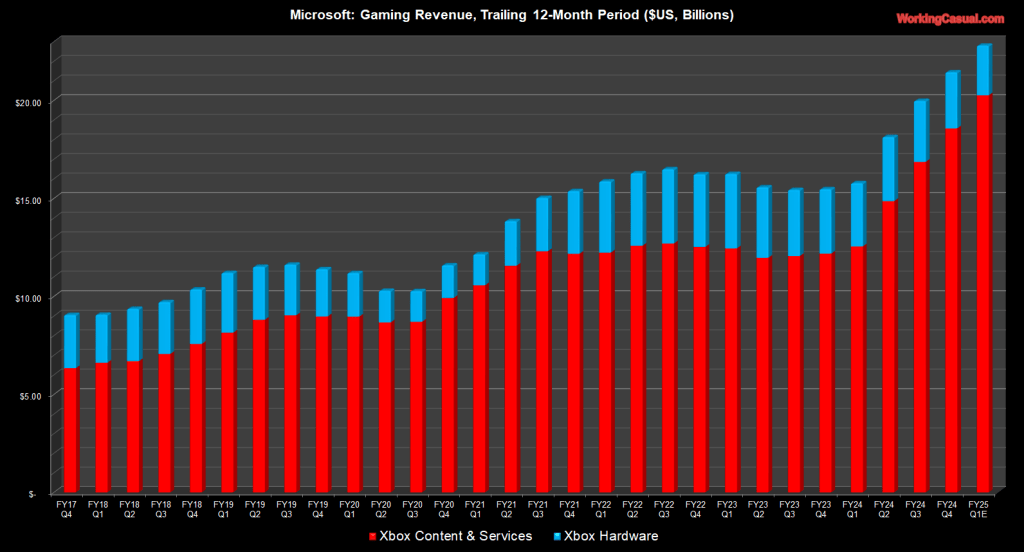

As expected after spending nearly $70 billion on Activision Blizzard, the inclusion of this new revenue pushed Microsoft Gaming to double-digit growth and record highs for a fourth quarter and 2024, marking the first time this business generated over $21 billion in annual sales.

Well, what’s behind these juicy headline numbers? And how does it compare to my estimate of where I expected them to be? Well, there’s plenty of questions around the Xbox business, and revenue came in below my personal expectations.

Looking beyond the deal impact, there’s a stagnancy setting in for Xbox over the last year, mainly as Game Pass shifts to user retention alongside a hardware business that under-performed and hit its peak this generation with Microsoft’s shift away from the traditional console approach.

“Stronger-than-expected performance in first-party content was partially offset by third-party content performance,” said Chief Financial Officer (CFO) Amy Hood when discussing the core content and services business during Q4. Which somewhat confuses me, as this must be referring to legacy Game Pass additions as opposed to new published titles.

Check below for the numbers themselves, my reactions to them, updated estimates for hardware shipments and some discussion around future forecasting.

Here’s the reported numbers from the filing and slides above, starting with the broader Xbox division.

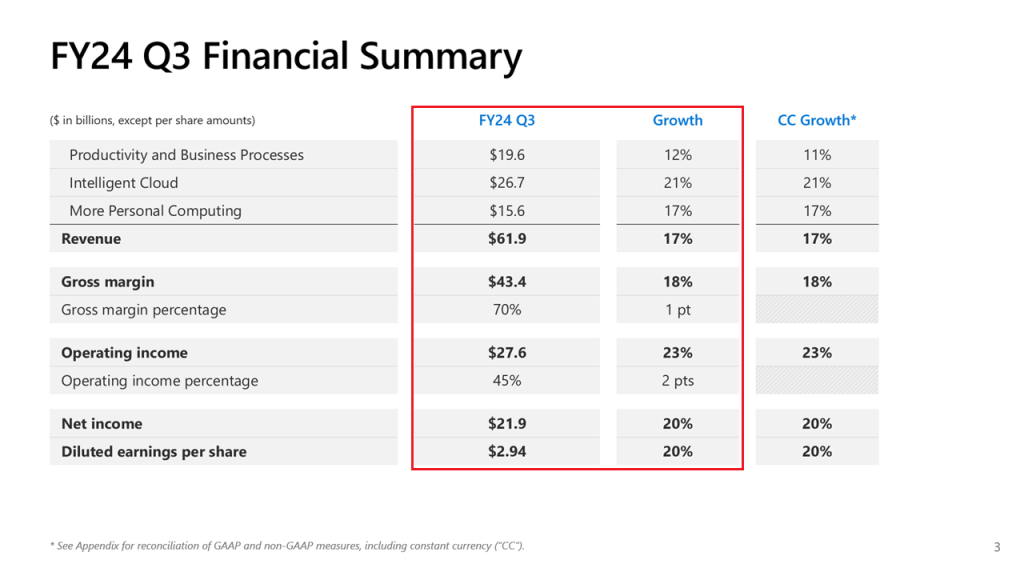

During the quarter ending June:

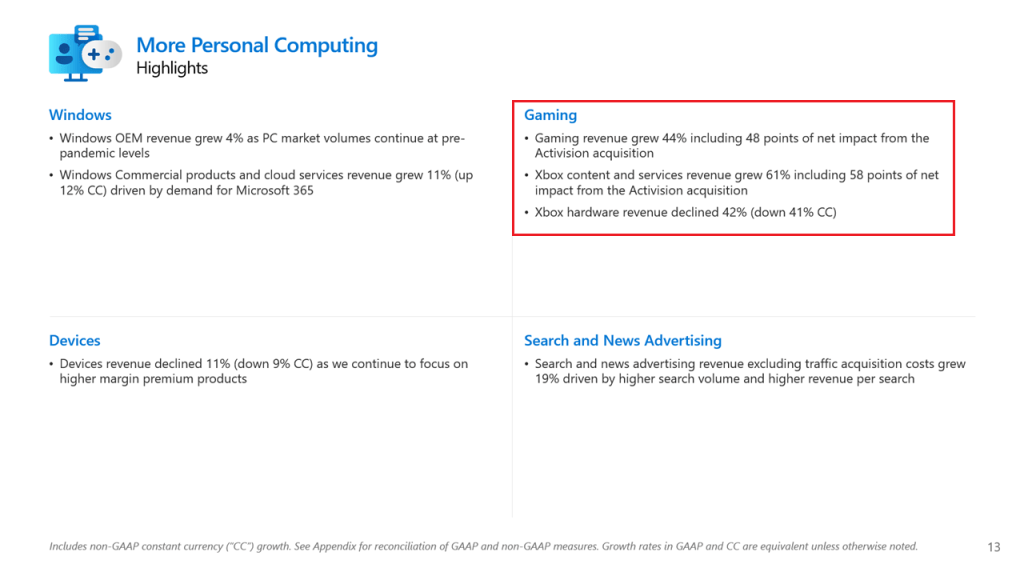

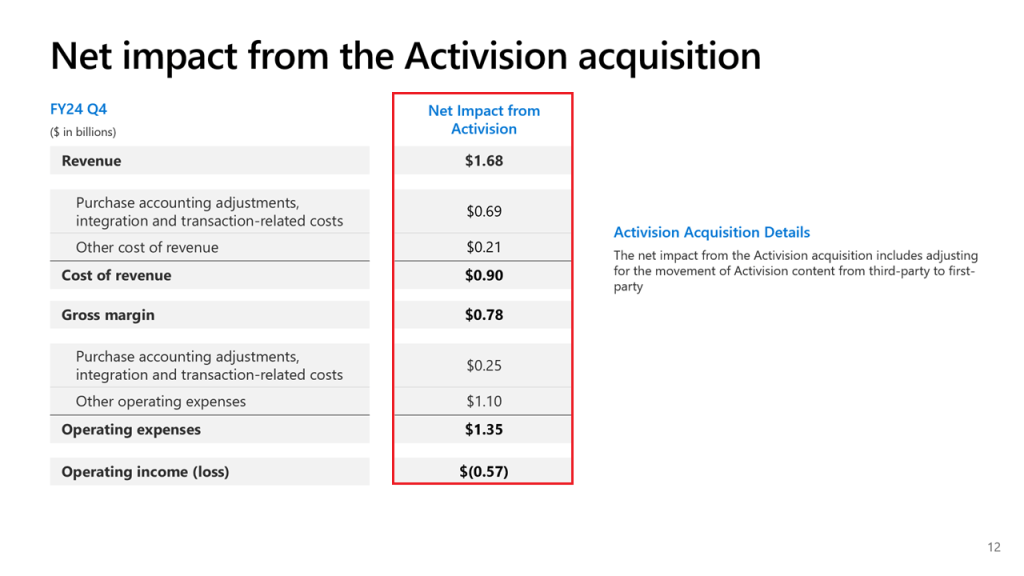

- Quarterly gaming revenue rose 44% to $5.02B.

- In-line with company guidance of low to mid-40s.

- That’s an all-time high fourth quarter.

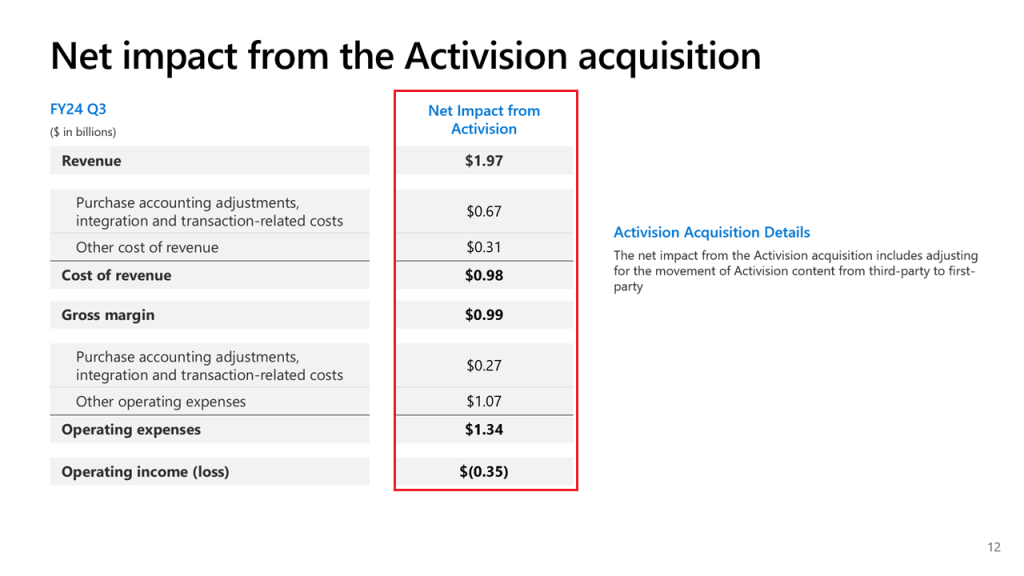

- ActiBlizz impact was $1.68B, or 48 points.

- Which means “all other Xbox” declined 4% to $3.34B.

Now for fiscal year 2024 revenue stats.

- Annual gaming revenue totaled $21.5B.

- That’s up 39% from prior year’s $15.5B.

- Ended slightly below my expectation.

- See the above chart for full historical context.

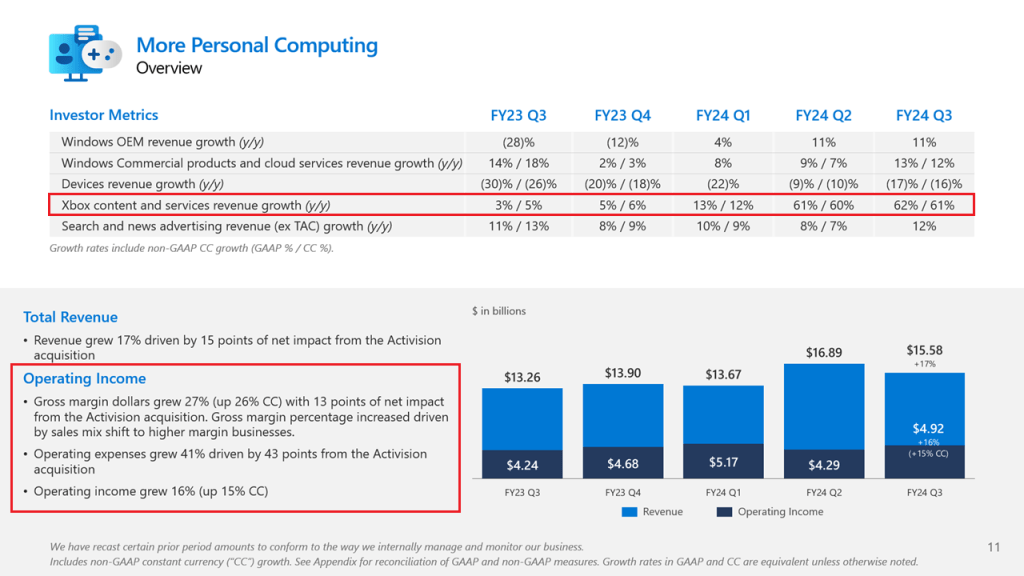

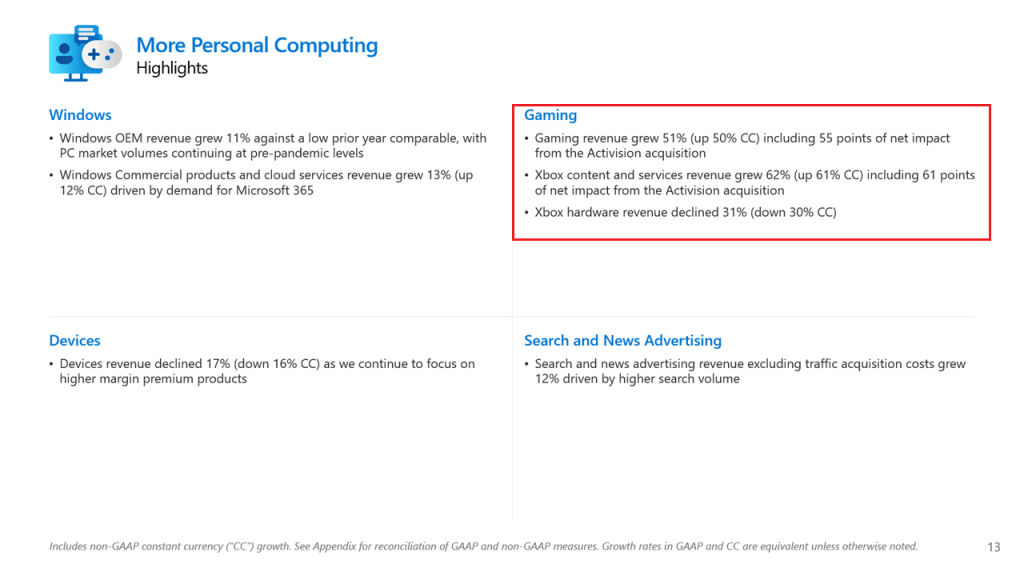

Underlying the dynamics was a boost in Xbox Content & Services, over 60% growth with most of the growth due to the acquisition, offsetting a substantial drop for Xbox Hardware well into the double-digits.

This certainly reflects the strategy of subscription and expansion beyond a retail box, plus the integration of a business that now has exposure to PC and mobile. Whether or not this is the right direction is the question, especially given how competitors still put a sizeable focus on the console business as a way to reach audience and sell their titles for full price at launch.

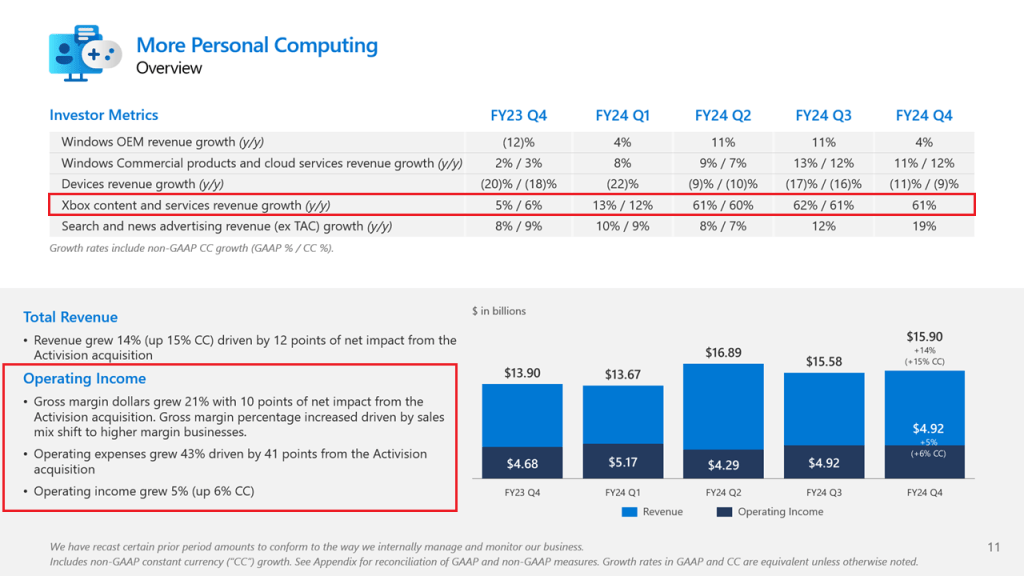

So far, I’ve talked about sales. While Microsoft doesn’t report profit for Gaming, we can infer from the broader More Personal Computing (MPC) segment’s movements.

- MPC group operating profit rose 5% to $4.92B.

- That’s after a 43% increase in expenses with 41 points from ActiBlizz.

The indication being that, for the time being, integration is dragging the bottom line and the core Xbox businesses might not be making up for it.

Now I’ll delve deeper into the individual product categories underlying its latest performance.

Starting with Xbox Content & Services, here are Q4 figures.

- Xbox C&S revenue jumped 61% to $4.66B.

- This represents 93% of total gaming sales.

- Best all time by a wide margin, over $1B.

- And that’s due to ActiBlizz contributing 58 points.

Here’s the content segment for the full financial year.

- Gained 52% up to $18.55B.

- Its contribution to the total was 86%.

- It’s larger than total gaming revenue in FY 2023.

- Last year Xbox C&S was $12.18B.

Then there’s the struggling Xbox Hardware category, with June quarter results detailed below.

- Declined 42$ to around $345M.

- The lowest Q4 result since FY 2020.

Again, now the annual figures for Xbox Hardware.

- Annual console sales declined 13% to $2.86B.

- Similar to above, the worse since FY 2020.

I’ll move on to a portion where estimates come into play, since Microsoft stopped reporting hardware unit sales ages ago.

- Last quarter, my guesstimate was 29.7M to 30.3M Xbox Series X|S lifetime.

- I have quarterly shipments again under a million, say 750K to 800K in the June quarter.

- If so, I believe it would be the lowest quarter this generation.

- Which means I have current Xbox Series X|S lifetime around 31M.

As part of the company’s conference call, Chief Executive Officer (CEO) Satya Nadella provided a couple breadcrumbs around engagement.

- 500M monthly active users (MAUs) across all platforms.

- Hour played on Fallout titles rose 5x quarter-on-quarter after Amazon Prime’s Fallout.

- And, that’s pretty much it.

It’s difficult to even decipher the meaning of monthly actives in this context, other than that mobile is massive and Microsoft purchased an entry point into that audience base.

Oh, and what’s missing? Game Pass subscriber numbers! Last we heard, it was 34 million as of February, conveniently after converting people away from Xbox Live Gold.

I always say one can learn as much from what a company doesn’t say as what it does. The distinct lack of transparency is another indicator of potential stagnation and uncertainty around elements of the business model, at least to me.

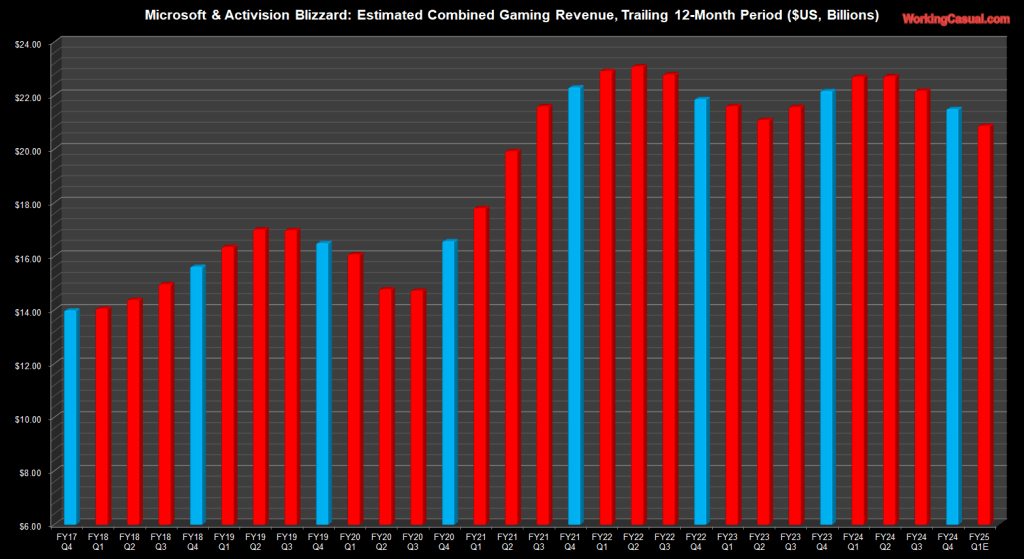

Here’s an angle I’d like to take before concluding. What might revenue look like if aggregating Microsoft Gaming and Activision Blizzard historically, then using that to calculate growth stats?

Granted, I had to make some assumptions. Mainly around the double-counting and the move from third-party to first-party. I still think it’s illustrative of the true history for the now combined entity, which tells more than seeing huge increases from the pre-acquistion days..

- My forecast initially put FY 2024 combined revenue upwards of $22 billion.

- As a reminder, the actual result was slightly below that: $21.5B.

- The key is that last year’s number, when combined, was $22.2B, implying a 3% decline.

I can attribute this to a few things. Either the revenue was lower, there were more synergies that impacted the post deal ActiBlizz portion, or my estimates weren’t as accurate as they could have been. Perhaps all of the above. Essentially, this isn’t bible. It’s illustrative and shows a more realistic barometer of the company’s recent trajectory.

Switching gears towards the future, here’s a look at Microsoft’s guidance for FY 2025 Q1.

- Gaming sales growth expected in the mid-30s.

- That includes 40 points of ActiBlizz Impact.

- Yes, so “everything else” will be down around 5%.

- The company anticipates Xbox C&S to rise in the low to mid-50s.

- Hardware will be “down.” (My estimate is in the mid-40s yet again.)

Here are these in dollar amounts, for the 3 months ending September.

- Q1 gaming revenue of $5.29B. Another record.

- For comparison, last year was $3.92B.

- Xbox C&S output would be $4.86B.

- Which means Hardware down to around $410M to $430M.

“The real goal here is to be able to take a broad set of content to more users in more places, and really build what looks more like to us, the software annuity and subscription business,” Hood said in response to a question. “With enhanced transactions and the ownership of IP, which is quite valuable long term.”

This is all well and good on an analyst call. As they say, proof is in the pudding.

Why close a valuable studio like Tango Gameworks, among other layoffs, if a quality pipeline is the key? What about the immediate portfolio, and where is the upside? It’s a light quarter upcoming for first-party, even with ActiBlizz. (I will note October to December will be more active in this regard.)

It’s more about older titles being added to Game Pass, including Call of Duty: MW3 this month, that could move the needle. Note the service’s structure changes took effect in July, and a price increase for existing users hits in September. Without that, I’m not sure these numbers could be achieved.

There is the busy release schedule for third party ramping up starting in August, such as perennial sports titles from Electronic Arts, which already has a certified hit with EA Sports College Football 25, plus there’s Ubisoft’s Star Wars Outlaws which I expect will be Massive.

That said, I think Microsoft meets the mid range of its outlook, with a little bit of upside for consoles as bigger third party blockbusters hit market.

It’s officially now a wrap on my first earnings recap of the season. Bookmark that calendar and stay tuned for more coverage soon! Be well, and stay safe everyone.

Note: Comparisons are year-over-year unless otherwise noted.

Sources: Company Investor Relations Websites, Xbox Support.

-Dom